Gaining Weight: Solactive Food Delivery Index

|

The food delivery industry is increasingly gaining weight. Multifaceted developments – from new technologies to broad changes in the global population’s mindset – are changing our attitude towards where we buy and consume our food. More and more, consumers are asking for it to be delivered to them, and multiple companies are reacting accordingly. Shocks such as the Coronavirus pandemic may further accentuate this shift. The Solactive Food Delivery Index Concept allows investors to gain exposure to companies providing food delivery services and alternatives. |

Food Delivery Market – An Industry Gaining Weight

According to McKinsey, two types of online platforms have established themselves in the food delivery industry. While both offer menu comparisons, reviews, and food ordering, they can be divided into Aggregators and New Deliveries. While Aggregators provide the traditional model of offering the possibility to order from multiple restaurants through a single online portal, New Deliveries also provide the additional necessary logistics for the restaurants to provide their delivery offerings. 1

Upcoming trends in the food delivery industry include food waste apps. 2 Since approximately one-third of the world’s food is lost or wasted every year, these apps try to sell unused or unsold food at a discount. 3 Another upcoming trend within this industry is in the field of pet food, which targets a very profitable niche segment, with a rising potential due to the humanization of pets – away from ownership – towards parenting. 2, 4

Several research studies and forecasts convey the same message: The global online food delivery market is growing very rapidly. According to IMARC, a market research company, the online food delivery market reached a value of USD 96 billion in 2019, after USD 84.6 billion in 2018, and is expected to further grow over the coming years. 5, 6 Another estimate by Frost & Sullivan, a consulting and market research firm, implies that the industry’s revenue could grow to USD 200 billion until 2025. 7 Hence, these predictions suggest that a doubling of food delivery’s market size within five years appears to be possible.

The current Coronavirus crisis and the necessity to engage in social distancing may change the food industry’s landscape – at least in the short term. Since many restaurants around the globe are temporarily closed, the food delivery business could compensate by boosting its sales. This will either be a one-off, or it may be a secular shift in consumer’s demand behavior towards a higher propensity to eat their favorite dishes without the necessity to leave their home or cook themselves. The latter option could, for instance, hold if new customers get to appreciate the convenience and comfort of having food delivered with the click of a button. Under the assumption that the online food delivery industry is positively affected in relative terms by the current global pandemic – either just temporarily or due to a lasting change in demand behavior – the aforementioned projections may eventually come to represent a lower bound. Hence, an already growing trend could get further accentuated in the years to come.

Index Composition

The Solactive Food Delivery Index Concept is composed of stores or restaurants providing delivery offers, hosts of delivery platforms, and delivery service providers. Some of its constituents are the following:

- Uber: provides the quickly growing online food ordering and delivery platform Uber Eats, which is available in over 50 cities distributed across 13 countries. 8

- Grubhub: featuring over 300,000 restaurants in over 3,200 U.S. cities and London, it is a leading online and mobile food-ordering and delivery marketplace. 9

- Meituan Dianping: establishing their e-commerce platform to offer food ordering and delivery services, they control over 50% of the Chinese food delivery market. 10

- Target: expanding its network to 1,500 stores in 47 U.S. states, they offer same-day delivery for a wide range of products, including groceries, directly through their website. 11

- Wingstop: a 1930s and 1940s aviation-themed restaurant chain specializing in chicken wings that offers delivery services across the United States via its over 1,000 restaurants.

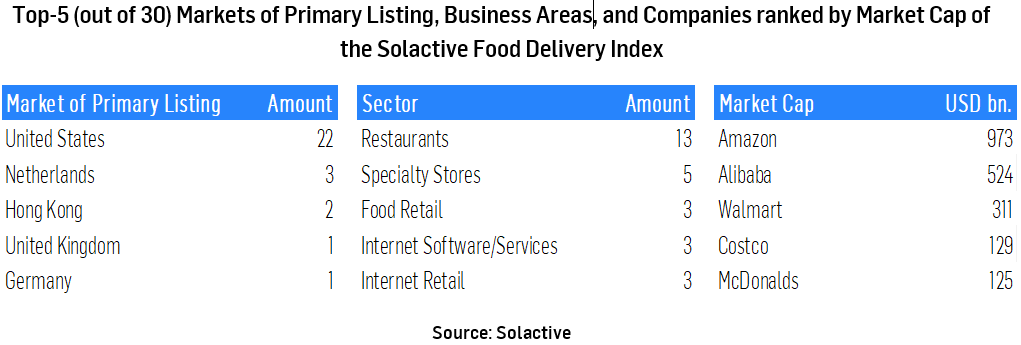

As of its current composition, the index is composed of 30 constituents. 22 of them are companies with primary listing in the United States, followed by the Netherlands with 3 companies, and Hong Kong with 2 companies. Furthermore, 13 companies operate in the restaurant segment, followed by specialty stores with 5 companies. Other business fields represented in the index are food retail, internet software/services, and internet retail. The index’s largest company by free-float market capitalization is – by far – Amazon, followed by Alibaba, Walmart, Costco, and McDonald’s. Its youngest companies, with respect to their date of incorporation, are Grubhub (incorporated in 2013), Habit Restaurants (incorporated in 2014), and Wingstop (incorporated in 2015). The smallest company in the index is Waitr Holdings, with a 6-month average daily traded volume (ADV) of USD 6mn and a free-float market capitalization of USD 111mn.

To obtain our company universe, we use ARTIS®, Solactive’s proprietary natural language processing software. ARTIS® stands for Algorithmic Theme Identification System. The algorithm identifies the thematic exposure of a broad set of companies by analyzing more than 500,000 text documents related to them and determining their degree of thematic relevance based on theme-related keywords given to the algorithm as an input.

Final Remarks

Technological advancements, as well as a change in consumer behavior, are causing a rise in supply and demand for food delivery services – from companies focusing just on connecting businesses with their clients, to restaurants offering delivery services, and companies with a much tighter grip across the food supply-chain. Additionally, shocks such as that induced by the Coronavirus pandemic may be accentuating the demand for this kind of services. The Solactive Food Delivery Index Concept offers investors the opportunity to gain exposure to this rising industry. Food delivery’s increasing relevance can be reflected by the Index’s performance during Q1 2020. During this period, an equally weighted version of the index would have dropped by 8.62% – a much smaller drop than the broader developed market’s -21.21% performance during this period. The food delivery industry will likely expand its services along changing ways of life and eating habits, and the Solactive Food Delivery Index Concept aims at selecting the greatest beneficiaries of this future trend.

Dr. Axel Haus, Team Head Qualitative Research

Javier Almeida, Qualitative Research Analyst

Solactive AG

References

[1] Hirschberg C. et al. (2016): “The changing market for food deliver”

[2] Fatbit (2020): „5 Trends Driving Changes in Online Food Ordering and Delivery Business“

[3] FAO (2020): “Food Loss and Food Waste”

[4] Mordor Intelligence (2020): „Pet Food Market – Growth, Trends, and Forecast (2020-2025)“

[8] Uber (2020): “Wann und wo ist Uber Eats verfügbar?”

[9] Grubhub (2020): “What is Grubhub?”

[10] Yang Y, Goh B. (2019): “China food delivery firm Meituan continues strong run since listing”

[11] Liptak A. (2019): “Target is now offering same-day delivery directly through its website”