Beyond Plastic Waste

The Solactive ISS ESG Beyond Plastic Waste Index addresses a problem that has become global. Its constituents are selected because they either reduce, reuse, or recycle plastic waste. The index provides an opportunity for investors to benefit from a global trend towards a greener future. |

THE DIMENSION OF PLASTIC POLLUTION BECOMES CHALLENGING

In 1950, global plastic production stood at 2 million metric tonnes per year. In 2015, production grew to 381 million tonnes of plastic, and the total sum of historically produced plastic reached 7.8 billion tonnes, which is around one tonne per person alive [1].

The world needs alternatives for cotton buds, single-use cutlery, plates, and straws, as well as for plastic containers for food and beverages. These are among the 10 most found plastic items on the beaches of Europe [2]. According to the Ellen MacArthur Foundation, there are more than 150 million tonnes of plastic in the ocean today, and by 2050, there could be more plastic than fish in the sea by weight [3]. The IUCN estimates that every year, 9.5 million tonnes of new plastic waste flushes into the ocean [4].

Around 80% of the maritime litter is plastic [5], and a Eurobarometer survey shows that about 87% of Europeans are worried about the environment in this context, whilst 74% have concerns about its impact on their health [2].

UNITED NATION’S SUSTAINABLE DEVELOPMENT GOALS

When it comes to environmental and sustainable investing, the UN’s Sustainable Development Goals (SDGs) are crucially important. A particular focus on health, preserving the environment, resources, as well as sustainability of consumption, production, and economic growth are of relevance in this respect. The related SDGs are 3 (Good Health and Well-Being), 6 (Clean Water and Sanitation), 9 (Industry, Innovation, and Infrastructure), 12 (Responsible Consumption and Production), 14 (Life Below Water), and 15 (Life on Land) [6].

INITIATIVES INFLUENCING THE CORPORATE WORLD

Initiatives by governmental and supranational institutions clearly indicate that there may be more regulation to come over the next years. Examples of this are:

- In September 2018, the UN launched the UN Environment’s Global Plastics Platform. Its goal is to reduce plastic pollution and support the shift towards a more circular economy [7].

- In June 2018, all G7-countries, except the US and Japan, agreed on a charter to work with the industry towards the production of fully recyclable or reusable plastic by 2030, and a significant reduction of unnecessary usage of single-use plastics [8].

- In March 2019, the EU Parliament, through a 560-35 majority (28 abstentions), voted for a ban on single-use plastics, such as the likes of cotton buds, cutlery, plates, and plastic straws. The ban should be effective by 2021. A further goal from its behalf is to reduce the waste of single-use plastic bottles [9].

Alongside stricter regulatory trends, many companies already incorporate sustainability goals into their corporate strategies. Investors anticipating future regulatory changes can already focus on investment targets that pay attention to environmental issues. Although changing value chains and production methods, or the use of different raw materials can be costly to implement, economic benefits may be reaped in the long run – when certain sustainability requirements become binding regulations. Early adaptors will probably bear higher costs in the short run, but will most likely also benefit from a competitive advantage later on. In this way, a focus on companies active in reducing, reusing, and recycling plastics could be regarded as a strategic ESG-risk-management approach.

Everyone should tackle the problem of plastic pollution now! Here’s a way to do so for investors. |

THE INDEX

The Solactive ISS ESG Beyond Plastic Waste Index is designed to track companies that exhibit a significant commitment to reducing, reusing, or recycling plastics, and, therefore, in the reduction of plastic waste.

The index focuses on companies that are active in the following three main categories:

Reduce: Companies offering viable substitutes to plastic-based products, as well as solutions that reduce plastic pollution. |

Reuse: Companies offering reusable products to replace single-use plastic items and companies providing services that enable the reuse of plastic products. |

Recycle: Companies offering plastic recycling solutions, and companies using a high share or amount of recycled plastic as raw material and inputs. |

The Solactive ISS ESG Beyond Plastic Waste Index is rebalanced semi-annually, and each of its components is equally weighted. On the selection date, ISS ESG will review its composition. Examples of its constituents are:

- Brambles Ltd.: The company is specialized in the provision of reusable pallets, crates, and containers in the field of containers & packaging. The company aims to achieve zero product waste to landfill by 2020.

- BillerudKorsnäs AB: The provider of renewable packaging material is active in the field of pulp and paper manufacturing and has clients in different industry segments.

- Rockwool International A/S: The company produces stone-wool-based products, embracing circularity by reusing and recycling old materials. Its products are made of up to 50% of recycled content.

- Shimano, Inc.: The bicycle parts manufacturer produces components for alternative means of transport. As tire erosion increases with weight, bicycles cause only a fraction of the plastic pollution generated by cars.

PERFORMANCE OF THE SOLACTIVE ISS ESG BEYOND PLASTIC WASTE INDEX

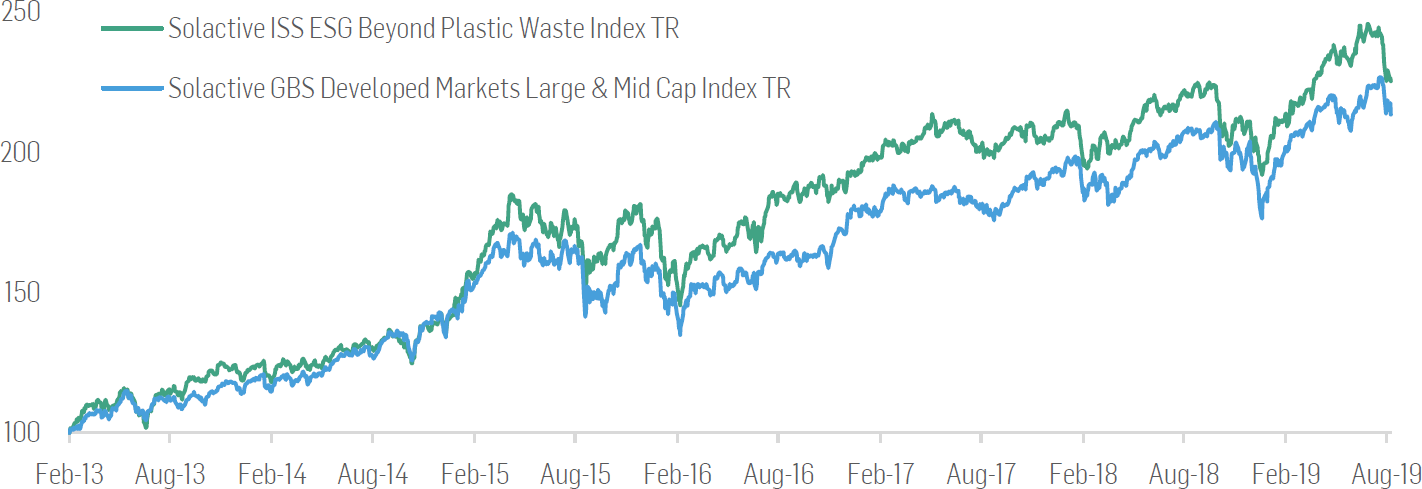

During the back-tested period between Feb. 02, 2013 until Aug. 14, 2019, the Solactive ISS ESG Beyond Plastic Waste Index performed well relative to the Solactive GBS Developed Markets Large & Mid Cap Benchmark. The average annualized return of the former stands at 13.26% compared to the benchmark’s 12.33%, if we consider their total return versions and use the latest composition as of selection date on Aug. 07, 2019. This performance does not come at the cost of higher fluctuations, as the Beyond Plastic Waste Index has an annualized volatility of 12.44%, which is slightly lower than that of the benchmark. Please note that we take the Developed Markets benchmark for the sake of simplicity, although the eligible index universe is comprised of global stocks. Based on its current composition, more than 80% of its constituents are stocks from Developed Markets.

Performance Comparison, Solactive ISS ESG Beyond Plastic Waste Index vs. Solactive GBS Developed Markets Large & Mid Cap Benchmark (Feb. 02, 2013 until Aug. 14, 2019)

FINAL REMARKS

The tremendous increase in the use cases for plastic products and the exponential rise of plastic production has resulted in a massive pollution problem that many institutions and companies are addressing. While solutions may not come overnight, many steps in the right direction are already being taken, and investors could benefit from the noble ambition of companies to reduce global plastic waste. First and foremost, everyone, including investors, should care about the future of the planet and the environment. Furthermore, the back-test of the Solactive ISS ESG Beyond Plastic Waste Index shows that a focus on sustainability and the environment, in the context of plastic waste, does not have to affect performance detrimentally. The problem of plastic waste will most likely not vanish in the short term, and companies offering solutions to reduce, reuse, or recycle plastic may have potential to grow from the efforts of tackling the challenge.

ESG-related investments provide rising opportunities for investors to participate in long-term trends and major economic shifts in accordance with the sustainability goals towards a greener future. Such investments are thus an essential element of asset allocation decisions.

Dr. Axel Haus

Team Head Qualitative Research

Solactive AG

References

[1] Hannah Ritchie and Max Roser (2019) – “Plastic Pollution”. Published online at OurWorldInData.org, https://ourworldindata.org/plastic-pollution .

[2] European Commission – “European Strategy for Plastics in a Circular Economy”, https://europa.eu/rapid/press-release_IP-19-2631_en.htm and https://europa.eu/rapid/attachment/IP-19-2631/en/Factsheet.pdf

[3] World Economic Forum, Ellen MacArthur Foundation and McKinsey & Company (2016) – “The New Plastics Economy: Rethinking the future of plastics”, http://www.ellenmacarthurfoundation.org/publications

[4] Boucher, J. and Friot, D. (2017) – “Primary Microplastics in the Oceans: A Global Evaluation of Sources”, IUCN, www.iucn.org/resources/publications

[5] IUCN, Issues Brief – “Marine Plastics”, https://www.iucn.org/resources/issues-briefs/marine-plastics

[6] United Nations – “Sustainable Development Goals”, https://sustainabledevelopment.un.org

[7] UN Environment – “Nations commit to fight plastic pollution together during the UN General Assembly”, https://www.unenvironment.org/news-and-stories/press-release/nations-commit-fight-plastic-pollution-together-during-un-general

[8] G7 2018 – “Ocean Plastics Charter”, http://publications.gc.ca/collections/collection_2018/amc-gac/FR5-144-2018-32-eng.pdf

[9] European Parliament – “Parliament seals ban on throwaway plastics by 2021”, http://www.europarl.europa.eu/news/en/press-room/20190321IPR32111/parliament-seals-ban-on-throwaway-plastics-by-2021

[10] Solactive AG – Index Guidelines “SOLACTIVE ISS ESG BEYOND PLASTIC WASTE INDEX”, https://solactive.com/downloads/Guideline-Solactive-ISS-ESG-Beyond-Plastic-Waste-Index.pdf