One Man’s Trash is Another Man’s Treasure: Solactive Waste Management Index

The amount and kind of waste we generate on our Earth is increasing from day to day, and it is humankind’s responsibility to tackle this problem accordingly. This task is not only important for the future of the environment, but also for the future of society. The Solactive Waste Management Index Concept allows investors to gain exposure to companies tackling the increasingly important issue of waste management, which is now more and more needed than ever before.

The Rising Importance of Waste Management

Every human generates waste. Even though the first municipal dump in the western world was created in Greece in the year 500 B.C., waste management has not been a big issue historically. 1, 2 However, ever since the dawn of the Industrial Revolution and the subsequent increase of waste consequential to it, waste management became a crucial and complex challenge for humanity to tackle in order to ensure a peaceful cohabitation. 3 Therefore, cities increasingly begun to rely upon waste containers and collection vehicles, as well as big facilities like incinerators and landfills to handle their waste. 2 Alongside further development and economic growth, new problems arose in the waste management industry – like hazardous or medical waste. Seeing this problem both as a business opportunity, as well as a contribution to society, people established enterprises and innovations in order to solve the issue, developing the big waste management industry existing nowadays.

The waste management industry consists of waste collection, waste disposal, and waste recycling companies, and is represented in landfills, incinerations, and combustions, as well as waste recovery and recycling, plasma gasification, composting, waste to energy, and waste avoidance and minimization. 4 Furthermore, a whole start up scene has been expanding along the lines of this topic. Recent waste catastrophes like the Kingston Fossil Plant coal fly ash slurry spill – as well as the generally increasing interest from the broader population to these kind of issues – have raised the level of awareness about waste management, motivating many entrepreneurs to tackle these challenges with innovative ideas. Big companies can also benefit from improving their waste management practices, as reducing waste can increase corporate profits whilst lowering costs for consumers. 5

An Insight into Waste

Waste composition consists of solid and energy waste. Solid waste is composed by discarded material resulting from a diverse set of processes. Examples of solid waste sources are food, paper, glass, or wood, among others. According to the World Bank, the biggest components of solid waste are food and green waste, as well as dry recyclables (e.g., paper, glass, and plastic waste). 6 Due to inefficient supply chains in developing countries and extreme consumption in developed nations, food is wasted even though a considerable part of the global population goes hungry. On the one hand, the quantity of dry recyclables is likely to rise in the upcoming years – especially because of emerging markets. On the other hand, technological progress offers possibilities to reduce them. Such can be the case if, as a simple example, e-documents increase in relevance in lieu of printed ones.

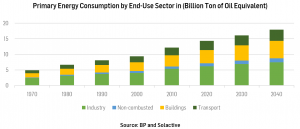

Energy waste is mainly produced by the industrial, construction, and transportation sectors due to high levels of energy consumption. 7 A significant proportion of modern factories are extremely inefficient in their use of energy and materials and have space for optimizing their resource management. 8 The transportation sector is steadily increasing its share of total CO2 emissions from road freight transport, and alternative fuels in aviation and shipping are still rare. 9 Furthermore, about 30% of the energy used by commercial buildings is wasted 10, all the while new clean electric buildings can reduce emission and cut costs in the construction process. 11

Influencing Changes in the Waste Management Industry

The price of waste treatment is expected to further rise. This assumption follows from the rising complexity of solid waste management, as – nowadays – there are many different collection systems for different waste streams. 12 Furthermore, recycling targets are rising. For instance, the EU is establishing harsher regulations for environmental protection and special taxes are being introduced – further increasing costs for the industry. 12

However, new technologies are disrupting the market. Advanced waste segregation plants are being built – all the while pneumatic refuse collection systems are changing the way waste is collected. 13 Technological advancements like waste-to-energy or the use of wastewater in the water-energy nexus are making it possible to generate electricity out of waste. 14 Furthermore, biodegradable plastics, or even plastic-eating worms, could mitigate the global pollution crisis. 15

One of the new challenges for the waste management industry is the increasing amount of electronic waste due to a rise in demand for electronic products, their ever-shorter product lifespans, and rapid innovation in the sector. 16 Besides the huge amount of electronic waste, their components pose another big problem as they mostly contain toxic materials like mercury or lead. 17

The Solactive Waste Management Index Concept

The Solactive Waste Management Index Concept aims to properly represent companies in the waste management industry, due to its increasing economic importance and business potential ahead. The companies that compose it are particularly involved in solid waste management.

To obtain our company universe, we use ARTIS®, Solactive’s proprietary natural language processing software. ARTIS® stands for Algorithmic Theme Identification System. The algorithm identifies the thematic exposure of a broad set of companies by analyzing more than 500,000 text documents related to them and determining their degree of thematic relevance based on theme-related keywords given to the algorithm as an input.

The Solactive Waste Management Index Concept is rebalanced semi-annually and each of its components are weighted according to their free-float market capitalization. To avoid a significant degree of concentration in larger companies, we set the constituents’ weight cap and floor to be 15% and 0.5%, respectively. The resulting index is composed by companies such as:

- Waste Management: the biggest waste management company in the United States with 43,000 employees and more than 500 million US-Dollar in alternative technology investments in over 100 companies. 18

- Biffa: the second-largest UK-based waste management company covering 95% of UK’s postcodes, which has received the Queen’s award for innovation for its plastic recycling facility Biffa Polymers. 19

- Tetra Tech: an American technical consulting company specializing in waste management, contaminated land, and water supply, with the goal of minimizing humanity’s collective impact on the environment. 20

- Schnitzer Steel Industries: a global leader in the metals recycling industry that tries to conserve natural resources by reusing and recycling scrap metal. 21

However, unless the recent shock significantly shifts the general stance against inappropriate waste disposal, as well as the global trend towards an eco-friendlier future, it could be argued that companies involved in waste management should recover from current systematic headwinds. Even more, if societies across the world continue to develop and industrialize, their waste generation will increase accordingly – further increasing the demand for services of those organizations willing, and able, to properly dispose an increasing amount of global waste.

Final Remarks

Waste and its management are crucial topics. The amount of waste we are generating is growing on a daily basis and new kinds of waste are coming along with new innovations. Given the negative consequences this issue represents for the environment and society, the Solactive Waste Management Index Concept offers investors a great opportunity to take part in the promising and future-oriented waste management industry. An investment in such an index would allow market participants to gain exposure to an industry whose rising trend is here to stay, therefore allowing them to potentially benefit from it whilst helping the world, as well as the environment, in the process.

Dr. Axel Haus, Team Head Qualitative Research

Javier Almeida, Qualitative Research Analyst

Solactive AG

References

[1] Barbalace K. (2003): “The History of Waste”

[2] 24/7 Waste Removal (2016): “The More You Know: Waste Management”

[3] Environmental Industry Associations (2013): “History of Solid Waste Management”

[4] Conserve Energy Future (2020): “What is Waste Management”

[5] UBS: “Future of Waste Part 1: Types, Sources and Impact”

[6] World Bank Group (2018): “What a Waste 2.0: A Global Snapshot of Solid Waste Management to 2050”

[7] BP (2020): “Energy demand by sector”

[8] MIT News Office (2009): “Manufacturing inefficiency”

[10] MIT Energy Initiative (2013): “Reducing wasted energy in commercial buildings”

[13] Rubbish Begone (2020): “The Future of Waste Management”

[14] GIZ (2017): “Waste-to-Energy Options in Municipal Solid Waste Management”

[15] Pirani F. (2017): “Can this plastic-eating bug save our planet?”

[16] UN Environment Programme (2017): “E-Waste Challenge”

[17] Planet Green Recycling (2020): “How to solve Americas growing E-Waste problem”

[18] WasteManagement (2020): “Going from waste collection to waste management”

[19] Biffa (2020): “Industrial & Commercial”

[20] Tetra Tech (2020): “Sustainability”

[21] Schnitzer Steel (2020): “Sustainability”