Methodology Change | Solactive J.P. Morgan Asset Management China Carbon Transition Index | Effective Date 13/12/2024

Solactive announces the following changes to the methodology of the following Indices (the ‘Affected Indices’). Methodology changes are effective on 13th December 2024.

|

NAME |

ISIN |

RIC |

|

Solactive J.P. Morgan Asset Management China Carbon Transition Index PR |

DE000SL0GMQ2

|

.SJPMCCTP |

|

Solactive J.P. Morgan Asset Management China Carbon Transition Index NTR |

DE000SL0GMR0

|

.SJPMCCTN |

|

Solactive J.P. Morgan Asset Management China Carbon Transition Index GTR |

DE000SL0GMS8

|

.SJPMCCTT |

Rationale for Methodology Change

Solactive has determined that to align the methodology of Solactive J.P. Morgan Asset Management China Carbon Transition index with the JP Morgan US and Global Carbon transition indices four additional relaxation constraints are to be added in step “2.3.12.1. Relax Holding and Liquidity Constraints”. These constraints relaxation of step 2.3.12.1 will only be applied in the Selection if Target WACI can’t be achieved with Maximum Turnover Threshold of 20%. If the Target WACI is achieved with Turnover less than 20% these constraints will not be relaxed.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline (ordered in accordance with the numbering of the affected sections):

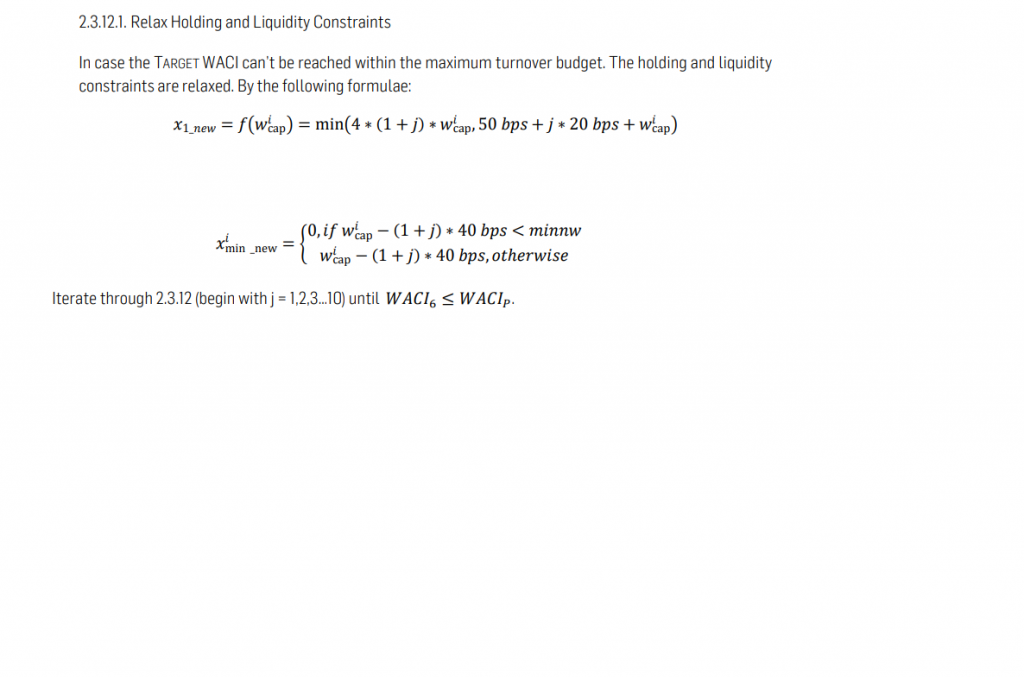

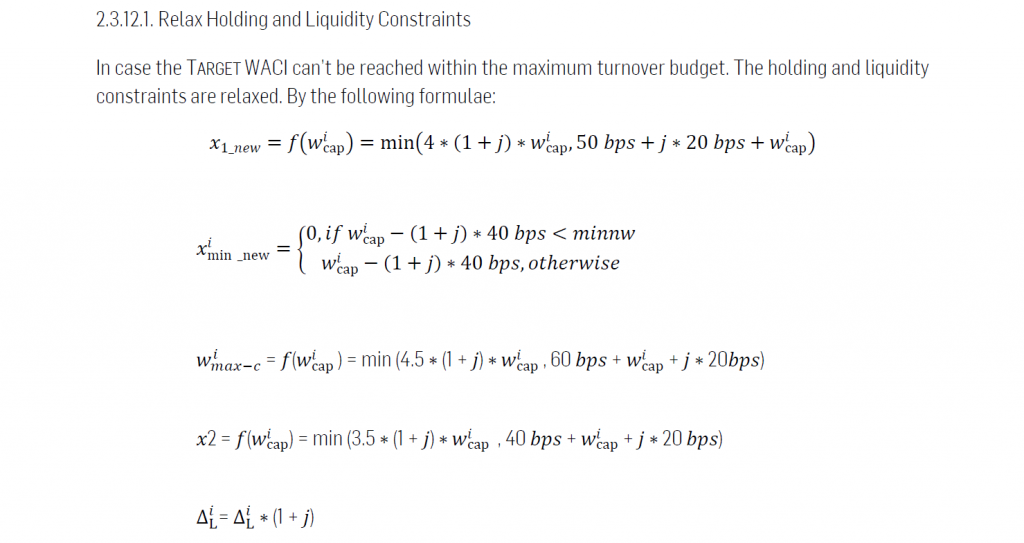

2.3.12.1 Relax Holding and Liquidity Constraints

From:

To:

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices. The amended version of the index guideline will be available on the effective date.