FOMO Sapiens: Solactive Experience over Goods Index Concept

Throughout time, consumption patterns are constantly changing. Nowadays, people often prioritize experience over material goods since the former provides profound emotions and long-lasting memories. The growing desire to be “liked”, along with the fear of missing out (FOMO) contribute to the rising demand for experience rather than goods. In the post-COVID era, the demand for traveling, concerts, and related services is expected to expand further. The Solactive ARTIS® Experience over Goods Index is set to benefit from the developing culture of enjoying experiences rather than owning things.

Solactive Experience over Goods Index Concept

People increasingly want to seize the moment, spend their income on gaining experience, enjoy experiences over goods, and access goods and services without ownership. Not only millennials but also the elderly generation change their lifestyles in favor of enjoying experiences and sharing goods. As a result, the consumption pattern is changing and shifting towards activities related to experience. Ultimately, established companies that adjust their business to serve new consumption needs and new companies that emerge due to this shift are benefiting the most, as this consumption shift converts into their revenue streams – and investors in shares of such companies benefit accordingly.1 The Solactive Experience over Goods Index Concept is designed to profit from changing values and shifting consumption mindsets. It tracks companies that are active in the fast-evolving experience economy. The index constituents sell emotions, feelings, and experiences through their services, or enable sharing things instead of owning goods. Overall, the index reflects both well-established businesses as well as new economy companies that provide experiences.

The Solactive Experience over Goods Index Concept is based on a global universe of common shares with an average daily trading volume of at least USD 1mn over the last 6 months before the selection date and a market capitalization of at least USD 100mn. Among the set of companies, the ones that are most relevant to the theme have been selected using Solactive’s proprietary natural language processing (NLP) tool ARTIS® (Algorithmic Theme Identification System). The relevant companies have been selected using keywords such as “entertainment tourism”, “accommodation sharing”, or “live entertainment event”, among many others. The resulting index of the 30 most relevant companies provides exposure to the following fields of the experience economy:

- Events organization (including planning and organization of festivals and concerts)

- Travel services (including accommodation, transportation, and popular vacation activities)

- Sharing economy, i.e., rather sharing than owning (including flat-sharing and ride sharing)

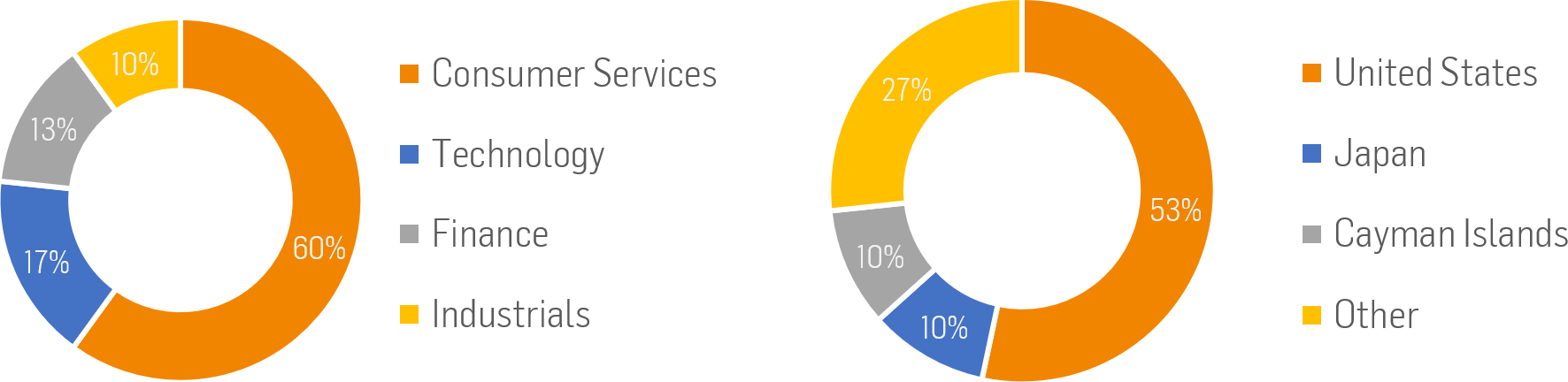

These fields are shaping the experience economy. Out of the 30 index constituents, 18 are active in the field of consumer services. Seven companies are active in the industry Hotels / Resorts / Cruiselines, with four hotel chains and three cruise line operators.

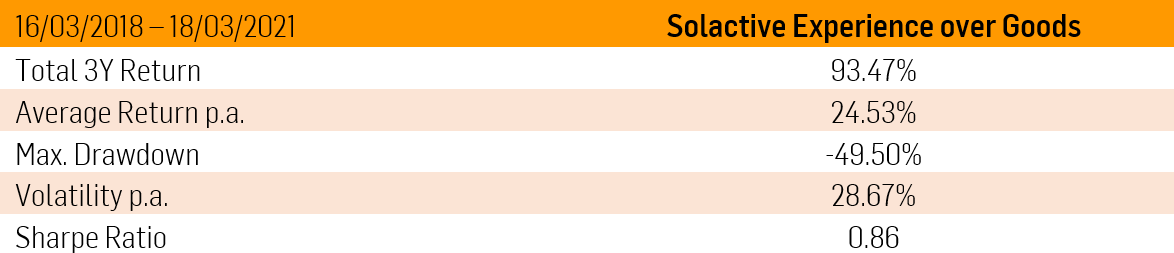

The index has a strong weight in consumer services companies. However, on sub-industry level, it appears well diversified despite its niche theme. The basket selected in February 2021 demonstrated an average annualized return of 24.53%, and a volatility of 28.67%, over a three-years back-cast ending in March 2021.

Source: Solactive

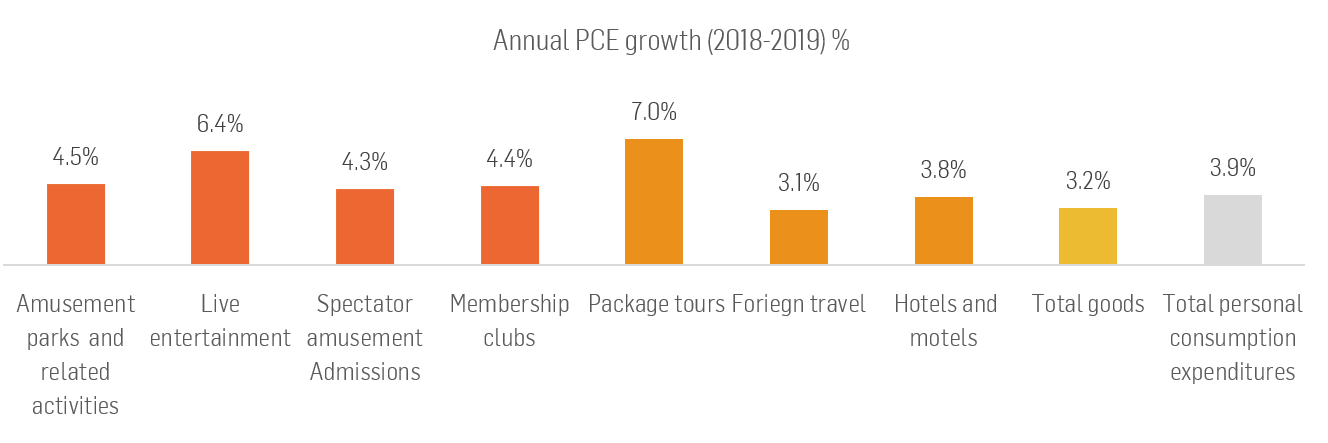

Source: SolactiveCurrently, more and more people desire to experience all that life has to offer. Although millennials may be the pioneers of this trend, older consumer cohorts also put more value on relationships and experiences, for instance, as they enter retirement. Consider baby boomers, who often have enough possessions, and who prefer to spend their money on experiences including vacations. This fact creates confidence in the sustainability of the trend. Over the past few years, personal consumption expenditures (PCE) on experience-related services apparently increased. As an example, in 2019 over 2018 – just before the COVID-19 crisis – expenditures of US consumers for services such as live entertainment (6.4%), amusement park activities (4.5%), and package tours (7.0%) increased faster than expenditures for total goods (3.2%) and total personal-consumption expenditures (3.9%).

Source: US Bureau of Economics Analysis2

Source: US Bureau of Economics Analysis2

Even product-focused industries are changing to become more experiential. Among others, many traditional retailers are moving to experience centers while creating showrooms for customers to experience products. Traveling, amusement parks, immersive activities (e.g., escape room games), live entertainment events, festivals, and concerts are among the wide spectrum of activities that attract plenty of customers. Consumers also continue to seek evening entertainment in the form of live performances, comedy clubs, piano bars, acrobatic performances, and dinner shows with themes. As experience and the sharing economy are closely interacting, companies such as Airbnb are leading the trend with new experiences offering.3 Through the sharing economy, one can find people willing to share their home or rent a bike while traveling and exploring amazing places.

After the COVID-19 meltdown, the experience economy is expected to face a sharp recovery. The pandemic has made people even more appreciative and grateful about life experiences. Given the happiness seeking nature of humankind, people will likely grasp every single moment to have life experiences when the world exits lockdown.

Experience economy vs Goods economy

Typically, economists identify three core economic offerings: goods, services – e.g., as intangible goods –, and commodities as inputs for goods and services. Nowadays, a fourth offering has emerged – experience. The term “experience economy” has its origin in the late 1990s, when B. J. Pine II and J. H. Gilmore published their article “Welcome to the Experience Economy”.4 The authors define experience as a memorable event that occurs when an individual does not only consume goods or services but is engaged with the company. It provides people with profound emotions, long-lasting memories, and satisfies the human desire to experience adventures. As a result, there is a shift in spending towards the experience economy.1 There are several driving forces of this shift, as, for instance:

- People are changing their perspective on what leads to happiness: Studies have found that spending money on experiences results in longer-lasting happiness and joy than material possessions.5, 6 The driving argument is that humans quickly adapt to their external surroundings. People stop appreciating goods after they become a part of daily life and quickly fade in the background. On the opposite, memorable experiences enable people to express more gratitude and appreciate their own positive emotions in those moments. Memories of these circumstances get sweet and nostalgic over time.

- Social media accelerates the growing demand for experiences that are shareable.1 By the nature of social media and the quest for likes, experiences such as traveling or festival attending are more likely leading to sharable pictures and stories than a new couch one just bought. Further, the constant stream of sharable experiences on social media makes other people feel peer pressure to join this trend, and millennials have given this anxiety a nickname: fear of missing out (FOMO).

- People desire to build communities and engage in social interaction. The ever-more connected and digitalized world enables us to create networks and gain experiences together. Further, people are more prone to have a conversation over their experiential purchases than their material purchases. There are more to talk about while people are sharing their cherish moments with each other. Recall the famous question of “What did you do this weekend?”.

Final Remarks

The experience economy is driven by humankind’s desire for entertainment and the strong interest in remarkable memories. Over the last decades, this need has challenged the desire to own goods. As a result, the demand for travelling, events, and related services is rising, as well as the people’s desire to enjoy benefits of goods without owning them. The Solactive Experience over Goods Index Concept is set to benefit from the culture of enjoying experiences rather than owning things. It is about a lasting change in consumer behavior and provides a unique opportunity for investors to benefit from the described profound shift in the consumers’ mindset. Especially after economies around the globe will re-open for good after repeated periods of lockdowns due to the COVID-19 pandemic, we expect the index constituents to prosper from a strong demand for their offerings.

Dr. Axel Haus, Team Head Qualitative Research

Solactive AG

References

[1] McKinsey (2017); Cashing in on the US Experience Economy.

https://www.mckinsey.com/industries/private-equity-and-principal-investors/our-insights/cashing-in-on-the-us-experience-economy

[2] Bureau of Economic Analysis, National income and product accounts.

https://www.bea.gov/

[3] What Is the Sharing Economy – Example Companies, Definition, Pros & Cons.

https://www.moneycrashers.com/sharing-economy/

[4] B. J. Pine II, J. H. Gilmore (1998); Harvard Business Review. Welcome to the Experience Economy.

https://hbr.org/1998/07/welcome-to-the-experience-economy

[5] Gilovich, Thomas, Amit Kumar, and Lily Jampol. “A wonderful life: Experiential consumption and the pursuit of happiness.” Journal of Consumer Psychology 25.1 (2015): 152-165.

https://www.sciencedirect.com/science/article/abs/pii/S105774081400093X

[6] Chaplin, Lan Nguyen, et al. “Age differences in children’s happiness from material goods and experiences: The role of memory and theory of mind.” International Journal of Research in Marketing 37.3 (2020): 572-586.

https://www.sciencedirect.com/science/article/abs/pii/S0167811620300045