Fixed Income: Semi-Annual Review – H2 2019

2019 – All Bond Indices with positive performance

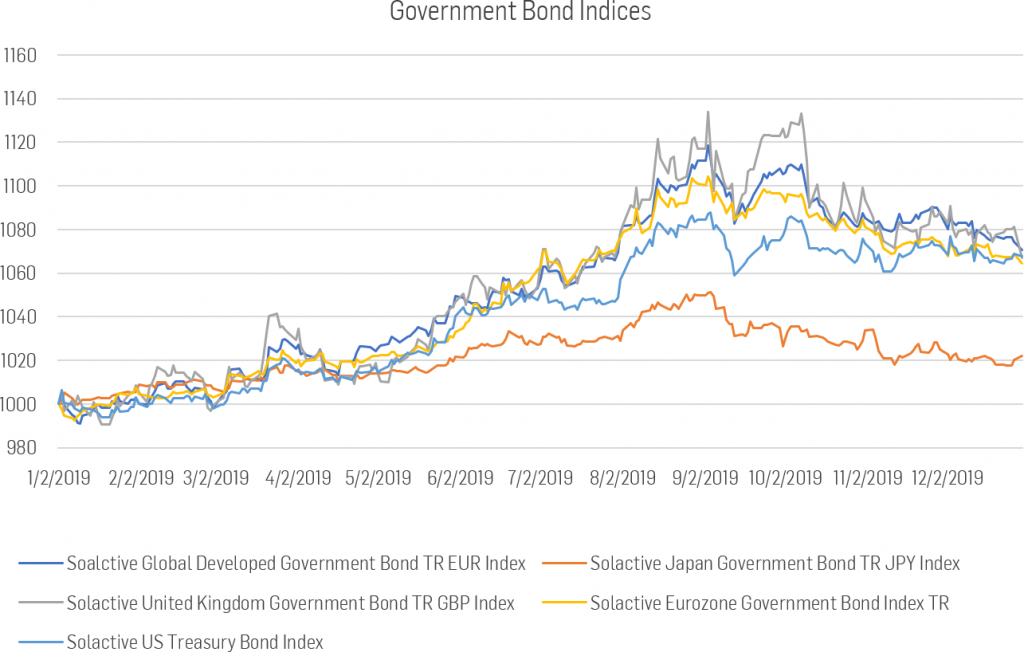

According to our index data, 2019 was a moderately good year for fixed income markets. The general trend was that fixed income assets developed quite well until the 3rd quarter and performed weaker in the last quarter. This development might especially mirror the overall relevance of several developments, i.e., the uncertainty due to the ongoing trade war between the US and China that in a way softened towards the end of 2019, or, for example, the Brexit where the picture got clearer due to new election in the UK. The Solactive Global Developed Government Bond TR EUR Index gained a total return of 7.07% – its best p.a. performance since 2015. On 3rd of September 2019 – just before the situation in Hong Kong relaxed due to Carrie Lam pulling the Extradition Bill that ignited the protests – our Solactive Global Developed Government Bond TR EUR Index reached an all-time high. Corporate bond indices performed even better than their sovereign counterparts. The Solactive USD HY Corporate Index and Solactive USD IG Corporate Index returned 15.13% and 14.61%, respectively.

|

Solactive Global Developed Government Bond TR EUR Index |

Solactive Japan Government Bond TR JPY Index |

Solactive United Kingdom Government Bond TR GBP Index |

Solactive Eurozone Government Bond Index TR |

Solactive US Treasury Bond Index |

Solactive Euro HY Corporate Index |

Solactive Euro IG Corproate Index |

Solactive USD IG Corporate Index |

Solactive USD HY Corporate Index |

|

|

2009 |

-1.20% |

0.98% |

-2.18% |

-3.63% |

75.13% |

15.50% |

17.23% |

56.13% |

|

|

2010 |

13.59% |

2.16% |

8.20% |

1.45% |

5.80% |

13.86% |

4.70% |

9.33% |

14.46% |

|

2011 |

9.59% |

2.04% |

17.48% |

3.28% |

9.71% |

-2.73% |

1.88% |

7.40% |

5.37% |

|

2012 |

-0.66% |

1.82% |

2.77% |

10.75% |

1.91% |

26.52% |

13.26% |

10.43% |

15.22% |

|

2013 |

-9.05% |

1.87% |

-4.33% |

2.29% |

-2.69% |

9.18% |

2.45% |

-1.94% |

5.85% |

|

2014 |

13.33% |

4.61% |

15.18% |

12.74% |

5.05% |

5.44% |

8.20% |

7.64% |

2.42% |

|

2015 |

7.92% |

1.29% |

0.46% |

1.30% |

0.82% |

0.98% |

-0.71% |

-0.72% |

-5.29% |

|

2016 |

4.81% |

3.52% |

10.99% |

3.05% |

0.95% |

8.63% |

4.66% |

5.09% |

17.65% |

|

2017 |

-5.96% |

0.22% |

2.02% |

0.27% |

2.30% |

6.63% |

2.39% |

6.59% |

7.26% |

|

2018 |

4.31% |

1.08% |

0.52% |

0.98% |

0.88% |

-3.67% |

-1.22% |

-2.52% |

-2.53% |

|

2019 |

7.75% |

2.18% |

7.39% |

6.81% |

6.84% |

10.92% |

6.23% |

14.67% |

15.22% |

Table 1: Annual Returns of Fixed Income Indices, Souce: Solactive AG

The Solactive United Kingdom Government Bond TR GBP Index has been especially volatile in the second half of 2019. The decoupling, which we saw earlier in the year, has stopped, and Japanese Government Bonds have even closed the performance gap to their international counterparts since October.

Figure 1: Performance Corporate Bond Indices 01.01.2019 to 30.12.2019, Source: Solactive AG

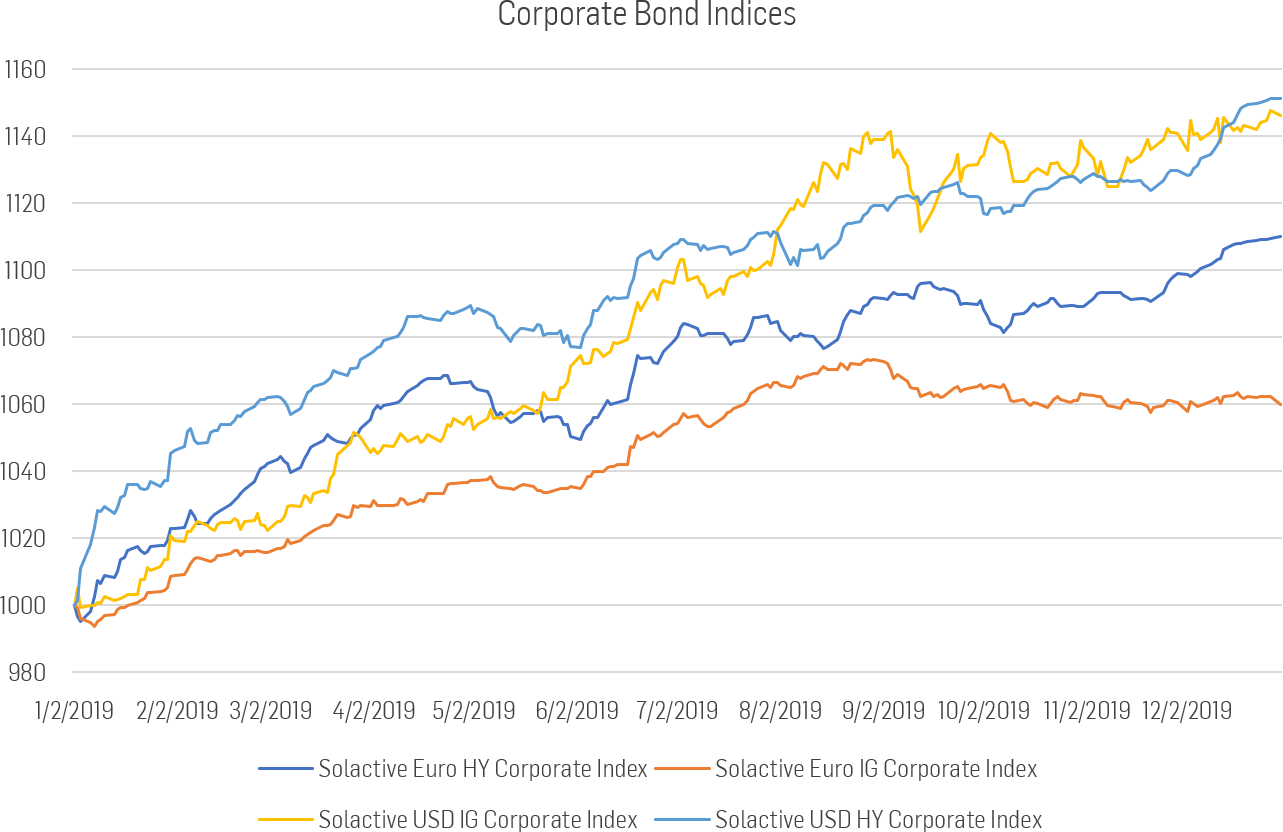

Similar to the first six months of the year, our Solactive USD High Yield Corporate Index remains the best performing corporate bond index with an annual performance of 15.13%. This accomplishment is closely followed by the Solactive USD Investment Grade Corporate Index, which returned 14.61%. The Euro corporate bond indices were not able to keep up the pace of the USD indices. The Solactive Euro IG Corporate Index and the Solactive Euro HY Corporate Index returned 5.98% and 11% in 2019, respectively. The USD indices particularly benefited from a higher yield level in the USD and three interest rate cuts by the FED in August, September, and October.

Figure 2: Performance Corporate Bond Indices 01.01.2019 to 30.12.2019, Source: Solactive AG

Lower Yields in EUR than in JPY

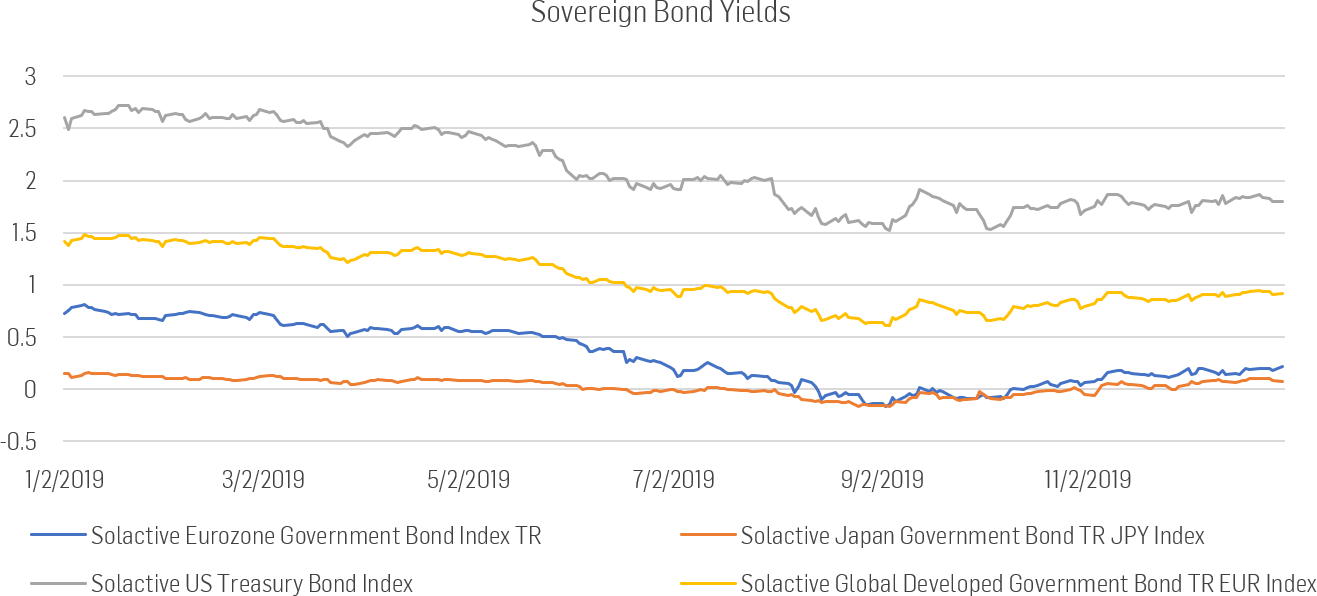

Yields have dropped for all major sovereign bond indices throughout 2019. Between August and October, there have been multiple occasions when the yield of the Euro Sovereign Benchmark dropped below the one of the Solactive Japan Government Bond TR JPY Index. Both the Japanese Government Bond and the Euro Government Bond indices spent a few weeks (August / October) in negative territory. Since then, yields in all currencies stabilized and turned positive. On an absolute basis, the yield of the Solactive US Treasury Bond Index dropped most (80 Bps.).

Figure 3: Sovereign Bond Yields in %, Source: Solactive AG

Solid Fixed Income Supply

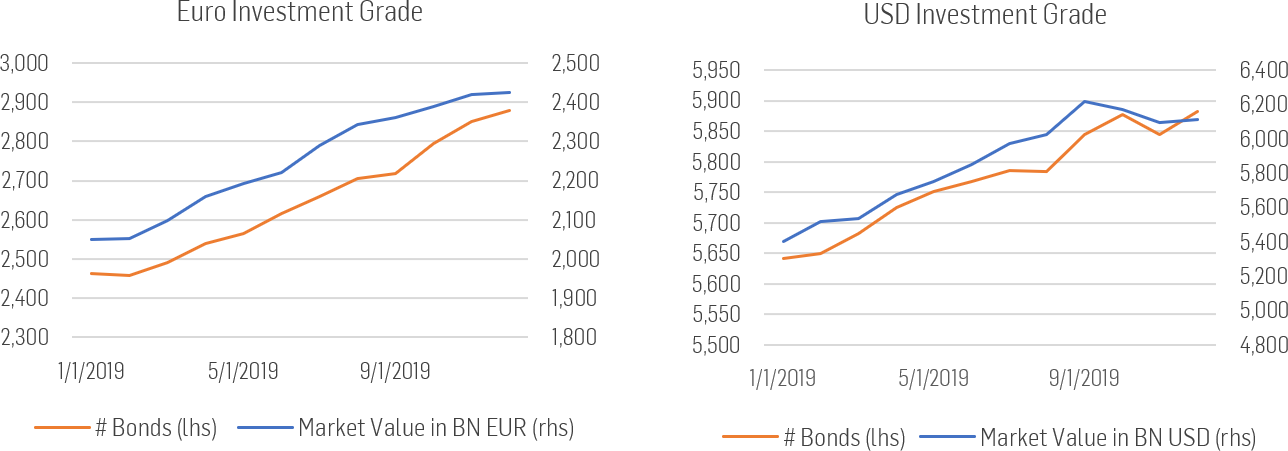

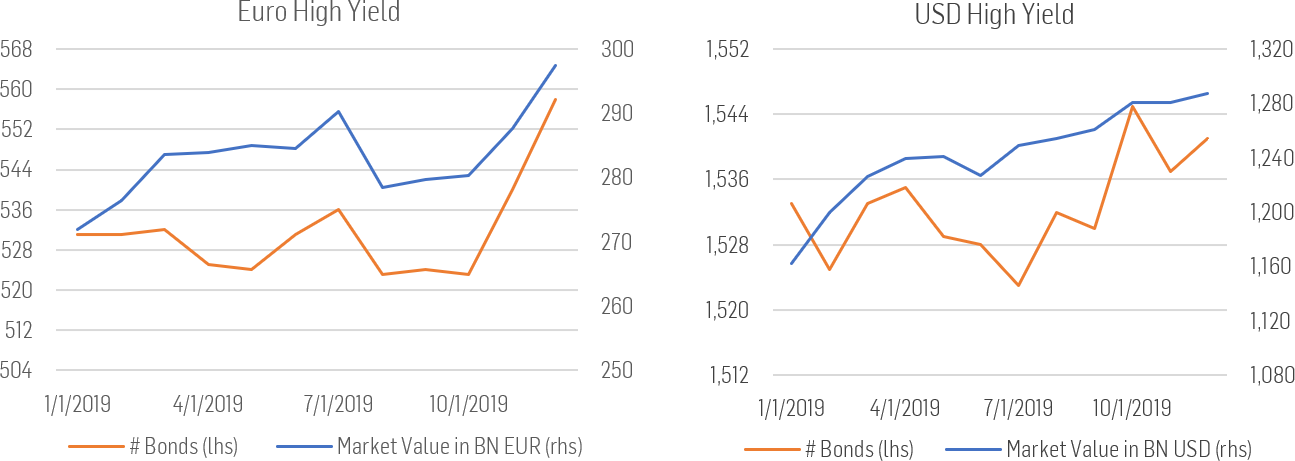

The following graphs show the net new issuance in our corporate bond benchmarks as well as the aggregated market value. Net Issuance has been strong for all four corporate bond indices. Especially the Euro Investment Grade supply has been steady and positive.

Figure 4: Investment Grade Bond Index Sizes, Source: Solactive AG

After some jitters in the high-yield market during the summer of 2019, global high-yield issuance increased healthily and found its footing again. One of the reasons here is the monetary policy change of the FED, which made lending conditions for high yield issuers attractive. Also, the more accommodative monetary policy with the restart of the QE program in October 2019 seemed to affect the issuance of Euro-denominated high-yield bonds.

Figure 5: High Yield Bond Index Sizes, Source: Solactive AG

Outlook for 2020

For 2020, we believe the popularity of Green and Social Bond to progress further, leading to an increase in issuances. For example, the German government recently announced to start the issuance of Green Bonds in the second half of 2020, joining the likes of the Netherlands and France[1].

We believe the favorable funding conditions, especially in the Euro area, will continue and, thus, issuance in the corporate bond sector will increase further. Governments will face increasing pressure for a more accommodative fiscal policy, which will lead to increased issuance of government bonds.

Especially the increasing popularity of green and social bonds will drive the demand for tailor-made indices in the fixed income space. We believe that in 2020, we will see a growing number of ESG indices and a greater flow of capital to track them.

Sebastian Alber

Fixed Income Indexing Product Development

Solactive AG

[1]https://www.reuters.com/article/us-germany-debt/germany-to-issue-first-green-bond-in-second-half-of-2020-idUSKBN1YN1CM