The Power of Voting: Active Ownership for Index Strategies

| “Passive” is growing at a fast pace. Hence, the issue of how to deal with share voting rights is becoming increasingly important. In this blogpost we attempt to address this question. |

Does the rise of passive investing threaten active ownership?

September 2019 marked a major milestone in US financial history as the assets managed under passive strategies (the selection of stocks based on a mechanical, rules-based approach) surpassed those under active strategies.1 The rise of ESG and its latest evolution, active ownership, is another megatrend within the investment world.

Are these two trends contradictory? Is passive investing incompatible with active ownership – one of the six tenets 2 of PRI’s principles of responsible investment? In this blogpost, we argue that it is not, and that clients and other stakeholders increasingly demand it from passive managers.

ESG – from the margins to mainstream fiduciary responsibility

ESG considerations have been included in the investment process for decades – starting with the exclusion from the investment universe of sectors or companies deemed by the asset owners or fund promoters to be unethical or against their values, e.g., cluster munitions.

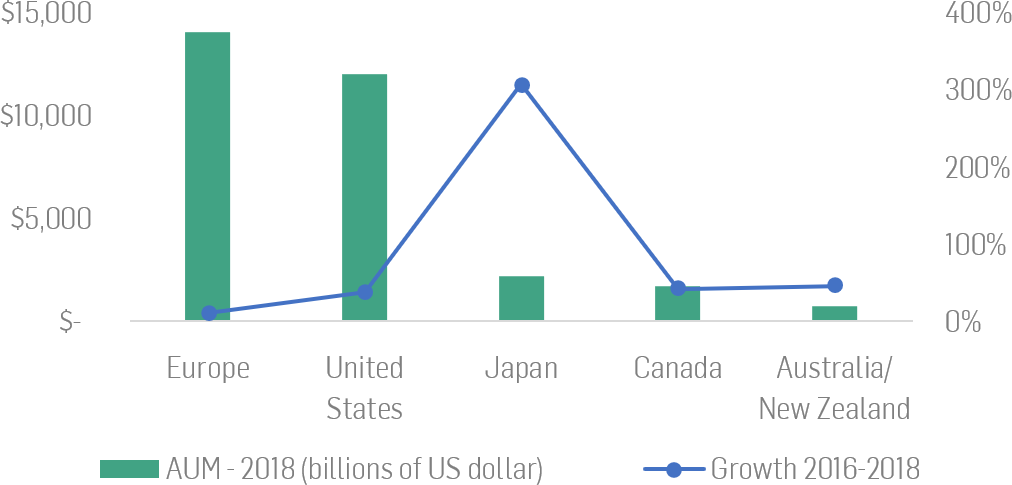

From there on, asset management’s evolution has been for investors to integrate ESG factors within their investment analysis and decision making, based on supporting evidence that ESG integration translates to reduced risks and improved returns.3 At the beginning of 2018, global sustainable investing in five major markets stood at USD 30.7 trillion, according to the 2018 Global Sustainable Investment Review.4

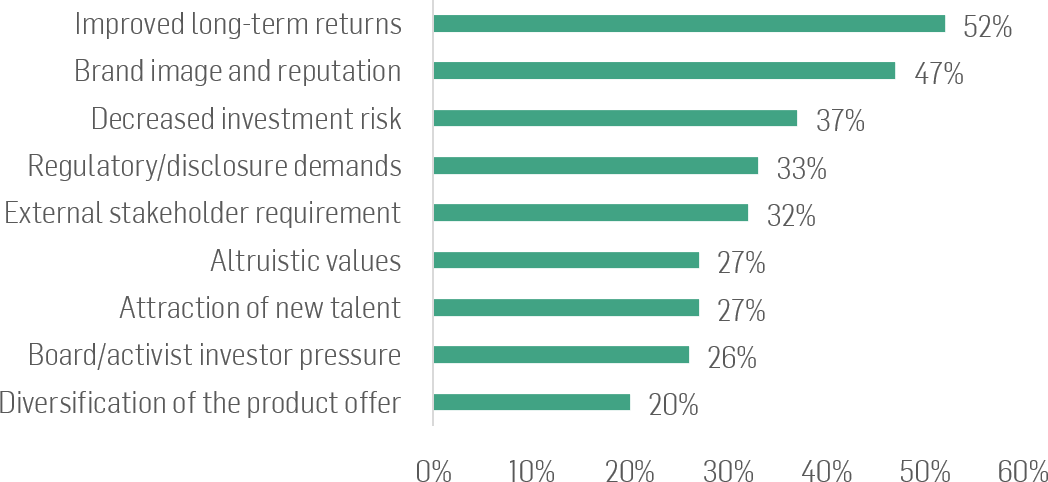

Figure 2: Drivers Behind ESG Integration in Investment Strategies

Source: BNP ESG Global Survey 2019

The rise of active ownership

The next frontier is for investors to incorporate share voting and corporate engagement into their core processes. Besides demand from ultimate beneficiaries (retail investors or institutional asset owners), there is a clear regulatory underpinning to that evolution.

For instance, in an echo of the UK’s Stewardship Code, the EU’s Shareholder Directive II (SRD2) requires institutional investors to develop and publicly disclose a policy on shareholder engagement or explain why they have chosen not to do so. This policy will describe how they integrate shareholder engagement in their investment strategy and the engagement activities they carry out.

The PRI defines active ownership as the use of the rights and position of ownership to influence the activities or behavior of investee companies. Active ownership can be applied differently in each asset class. For listed equities, it includes engagement and voting activities.

The standpoint of asset owners as the ultimate decision makers is becoming more important: they expect all their managers to be active owners.

| “We depend on passive managers to do more engagement and (carry out) an active ownership role.” – Horomichi Mizuno, CIO, GPIF 5 |

In light of this client demand, are investors playing an active ownership role beyond ESG integration? We would contend the answer is that we see signs, but there is much room for improvement.

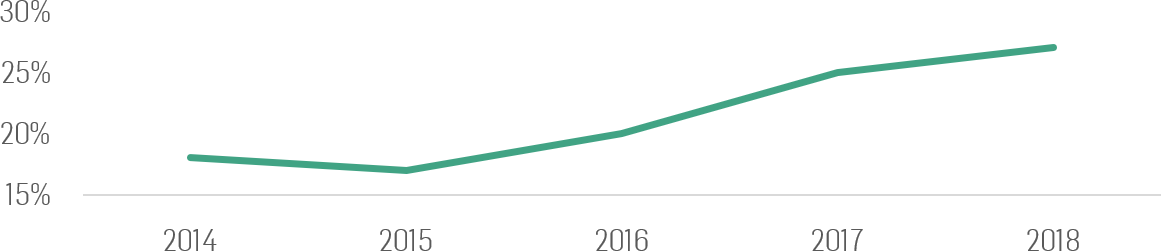

On the one hand, some trends are clear. In 2018, the percentage of shares voting in favor of environmental and social proposals rose to an all-time high of 27%.6

Figure 3: Percentage of Shares Voted in Favor of Social/Environmental Proposals Annually

Source: 2018 Proxy Season Review

We also observe asset owners such as the USD 238 billion California State Teacher’s Retirement System (CalSTRS) embracing active dialogue. While over 60% of its equity funds are indexed, the fund is not only using its proxy power to influence investee companies but also partnering with activist fund managers in engagement and voting.7

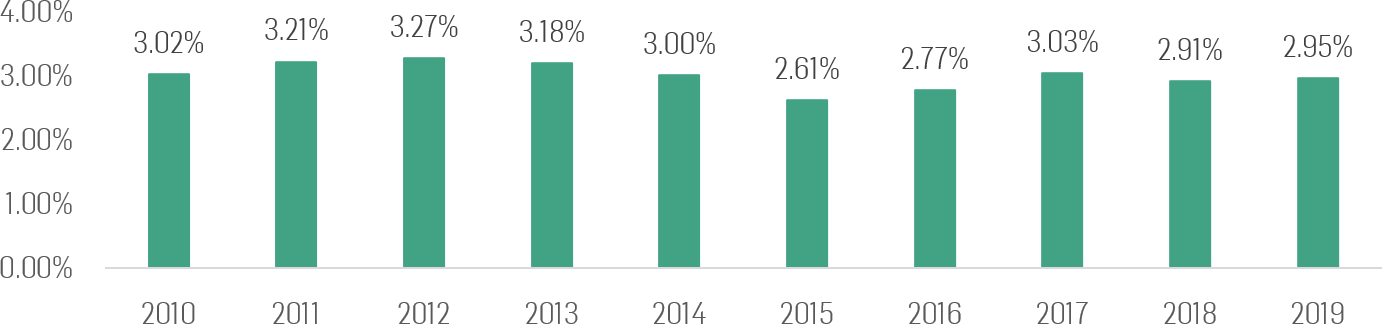

On the other hand, we would expect that if active ownership was truly increasing, overall shareholder dissent would also be on the rise. On that front, the evidence is less clear. A Minerva Analytics study (note: Minerva is a member of the Solactive Group) of the 2019 UK proxy season showed, for instance, that overall shareholder dissent had barely budged over the last ten years. One could infer from this that investors, despite the intense discussion about ‘engagement’, are still not doing enough to use their vote in order to influence management actively.

Figure 4: Shareholder dissent in the UK Top 350

Active Ownership and Passive Investing – the Solactive View

Asset managers exist to serve their clients, be it through active or passive investment strategies. Clients and regulators are clear that active engagement is increasingly encouraged as well as being a fiduciary duty, no matter the investment style.

In the case of passive investing, the requirement to be an active owner is even more pronounced as the decision by the manager to ‘sell’ a company which he or she views as poorly guided is at odds with the passive (and deterministic) stock selection process. Thus, once an index has been chosen, engagement and voting are the only routes for passive managers to express their views while fulfilling their investment mandate.

We, therefore, argue that far from there being an incompatibility between passive management and active engagement, there is, in fact, an elevated need for passive managers to act as active owners. With the thoughtful exercise of ownership rights – including their right to vote – asset managers, active and passive, can help ensure that companies and their management are held accountable to capital providers and ultimate beneficiaries.

Timo Pfeiffer

Chief Markets Officer

Solactive AG

Sub-note

Solactive is a PRI signatory and has a longstanding commitment to responsible investing. Through our wide range of ESG indices, thematic investment ideas, partnerships with ESG data providers, and a strategic investment 8 in Minerva Analytics, the European proxy voting and sustainability governance research firm, we continue to grow and support new avenues in responsible investing and active stewardship.

References

[1] Collins (2019), “As Index Funds Overtake Actively-Managed Funds You Should Beware of The Herd”

[2] United Nations, “What are the Principles for Responsible Investment?”

[3] BNP Paribas (2019), “ESG Global Survey 2019: Investing with Purpose for Performance”

[4] Global Sustainable Investment Alliance, “2018 Global Sustainable Investment Review”

http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf

[5] Riding (2019), “World’s biggest pension fund steps up passive stewardship efforts”

https://www.ft.com/content/8e5e0476-f046-3316-b01b-e5b4eac983f1

[6] ProxyPulse (2018), “2018 Proxy Season Review”

https://www.broadridge.com/_assets/pdf/gated/broadridge-2018-proxy-season-review.pdf

[7] Flanagan (2014), “CalSTRS Plays Role of Shareholder Activist”

https://www.marketsmedia.com/calstrs-plays-role-shareholder-activist/

[8] Solactive (2019), “Press Release: Solactive makes strategic investment in European governance, sustainability, and proxy voting firm Minerva Analytics”

https://www.solactive.com/wp-content/uploads/2019/05/Press-Release-Solactive-makes-strategic-investment-in-European-governance-sustainability-and-proxy-voting-firm-Minerva-Analytics.pdf