Methodology Change | Solactive U.S. Large & Mid Cap Value 100 Index| Effective Date 20/10/2020

Today, on the 15/10/2020, Solactive announces the following changes to the methodology of the following Index (the ‘Affected Index’):

| NAME | RIC | ISIN |

| Solactive U.S. Large & Mid Cap Value 100 Index | .SOUSLMVT | DE000SLA5ZZ6 |

Rationale for methodology change

The Index aims to track 100 stocks from the US equity market that exhibit strong value characteristics as measured by 3 common value measures (book-to-market, dividend yield, and price-to-earnings). Given that all of the 3 value measures are based on fundamental reported measurements by the company, these end up largely influenced by accounting differences among various industries. This makes it rather difficult to compare company ratios across industries and leads thus to a distorted sector exposure in the index.

In order to ensure the scope of the index is correctly fulfilled, Solactive makes an adjustment to the normalization procedure applied to the index, so that this is done sector-neutrally, rather than across the entire universe. This approach will bring the methodology in line with broad market standards and balance the sector exposure.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline (ordered in accordance with the numbering of the affected sections):

Section 2.1 Selection of the Index Components

Old Text:

[…]

For all companies in the Index Universe a Value Score is calculated as follows:

[…]

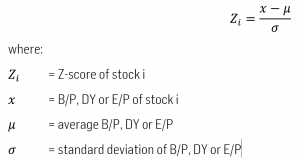

2. Calculate a z-score for each of the three metrics under 1.a-1.c as:

3. Calculate the Value Score for each stock as the average of the three z- scores. If a stock has less than 2 z-scores available, it is dropped from the universe

[…]

New Text:

[…]

For all companies in the Index Universe a sector-neutral Value Score is calculated as follows:

[…]

2. Calculate a sector-neutral Z-score for each of the three metrics under 1.a-1.c as:

3. Calculate the sector-neutral Value Score for each stock as the average of the three sector neutralized Z-scores. If a stock has less than 2 Z-scores available, it is dropped from the universe

[…]

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices. The amended version of the index guideline will be available on the effective date.