Methodology Change | Solactive Indices | Effective Date January 10th 2025

Today, on the January 3rd 2025, Solactive announces the following changes to the methodology of the following Indices (the “Affected Indices”):

| NAME | RIC | ISIN |

| Solactive – B-BRE Israel Commercial Real Estate Index | .SOBBREIL | DE000SLA2BB5 |

| Solactive – B-BRE Residential Real Estate Index | .SOBBRERZ | DE000SLA14D9 |

| Solactive – B-BRE Residential Real Estate Index GTR | .SOBBRERZG | DE000SLA14E7 |

| Solactive – B-BRE Tel Aviv 125 Low Volatility High Dividends Index | .SOBBTAHD | DE000SLA2RX5 |

| Solactive – B-BRE US REIT (NTR) Index | .SOBBNTR | DE000SLA1JC8 |

| Solactive – B-BRE US REIT Index | .SOBBREIT | DE000SLA0203 |

| Solactive B-BRE Israel Infrastructure Index NTR | .SOBBINFN | DE000SL0AV98 |

| Solactive B-BRE Israel Infrastructure Index PR | .SOBBINFP | DE000SL0AV80 |

| Solactive B-BRE Israel Infrastructure Index TR | .SOBBINFT | DE000SL0AWA8 |

Rationale for Methodology Change

Solactive AG is constantly reviewing its indices and the approach of their index calculation. In order to harmonize the applied calculation methodologies, Solactive AG has decided to change the methodologies of the Affected Indices.

Changes to the Index Guideline

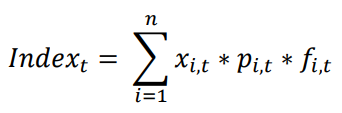

The Affected Indices are currently calculated using the formula of a Standard Index as defined in section 1.2.1 of the Equity Index Methodology available on the Solactive website: https://www.solactive.com/documents/

The changes refer to the index calculation itself and the corporate action adjustment (section 2.1.1.1 and following sections of the Equity Index Methodology referring to the Standard Index).

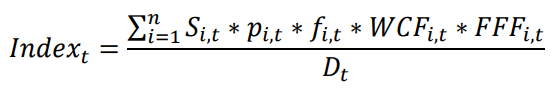

The change relates to the amendment of the calculation formula for the Affected Indices to the Divisor Index logic as defined in section 1.2.2 of the Equity Index Methodology (the index calculation itself and the corporate action adjustment are to be changed as referred to in section 2.1.1.2 and following sections).

To illustrate the change, the calculation formula will change from:

To

Further details on the Index logic as well as definitions of the Symbols included in the above formulas are available in the Equity Index Methodology on the pages 4 and 5. As a result, all relevant paragraphs which refer to the calculation of the Affected Indices and, if applicable to the rebalance specific procedure will be amended to comply with the Divisor Index standards.