Methodology Change | Solactive Australian Government 7-12 Year AUD TR Index | Effective Date 18 January 2022

Today, on the 12th of January 2022, Solactive announces the following changes to the methodology of the following index (the ‘Affected Index‘):

| NAME | RIC | ISIN |

| Solactive Australian Government 7-12 Year AUD TR Index | .SOLAUGOV | DE000SLA8SH3 |

Rationale for Methodology Change

Solactive has determined that a change is warranted regarding the coupon and cash reinvestment schedule of the Affected Index in order to enhance consistency across Solactive Australian Fixed Income indices. The methodology change consists of switching from a periodic cash reinvestment schedule to a direct cash reinvestment schedule. The change will bring the Affected Index’s treatment of cash arising from corporate actions in line with other Solactive Australian Fixed Income indices which also follow this schedule.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline:

From (old version):

“[…]

4.1 Index Formula

The Index is calculated as a total return index.

A total return index seeks to replicate the overall return from holding an index portfolio, thus considering both coupon payments and Corporate Action proceeds in addition to the price changes adjusted for any accrued interest. Coupon and other cash payments will be reinvested on the monthly basis.

The Index calculation is performed according to the Bond Index Methodology, which is available at www.solactive .com.

The base market value formula implies a periodic reinvestment in the Index of proceeds resulting from corporate actions and coupon payments in respect of the Index Components on the next regular Rebalance Day following such events. For the period until reinvestment the proceeds are held in a cash component. On the Rebalance Day the proceeds are reinvested in the Index proportionately to the weights of the Index Components. The base market value formula tracks the performance of the Index Components relative to their market value on the immediately preceding Rebalance Day. The market value for a single Index Constituent on a Rebalance Day is based on the price for the respective bond and its face value on the Selection Day associated with the Rebalance Day.

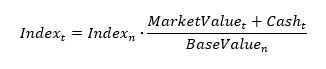

The formula is expressed in mathematical terms as follows:

A more detailed description of the mechanics of the base market value formula can be found in the Bond Index Methodology.

[…].”

To (new version):

“[…]

4.1 Index Formula

The Index is calculated as a total return index.

A total return index seeks to replicate the overall return from holding an index portfolio, thus considering both coupon payments and Corporate Action proceeds in addition to the price changes adjusted for any accrued interest. Coupon and other cash payments will be reinvested on a daily basis following the direct reinvestment formula.

The direct reinvestment formula implies a daily reinvestment in the Index of proceeds resulting from corporate actions and coupon payments in respect of the Index Components on the effective date of such events. The reinvestment will be undertaken proportionately to the weights of the Index Components. The direct reinvestment index formula stipulates further that the level of the Index changes based on the change of the prices of its Index Components taking into account their weight in the Index.

A more detailed description of the mechanics of the direct reinvestment formula can be found in the Bond index Methodology under Section 1.2.1, which is available on the Solactive website: https://www.solactive.com/documents/bond-index-methodology/.

[…].”

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices. The amended version of the index guideline will be available on the Effective Date.