Methodology Change | Solactive 3D Printing Index | Effective Date 13th January 2020

On 23 December 2019, Solactive announces the following changes to the methodology of the following indices (the ‘Affected Indices‘):

| NAME | RIC | ISIN |

| Solactive 3D Printing Index | .SOLDDD | DE000SLA3DP9 |

| Solactive 3D Printing Index (CHF) |

.SOLDDDC | DE000SLA3D23 |

| Solactive 3D Printing Index (USD) | .SOLDDDU | DE000SLA3D15 |

Rationale for Methodology Change

The rationale behind the determined methodology change is to increase the threshold on three-month average daily trading volume significantly to ensure that only underlyings with sufficient liquidity are entering the index which will improve and facilitate index replication. This change will also ensure moderate turnover on the semi-annual rebalances while improving the underlying index liquidity.

Changes to the Index Guideline

The following definitions will be updated with the new wording as follows:

Section 1.5 Weighting:

- Old Wording:

On each Adjustment Day each Index Component of the Solactive 3D Printing Index (SOLDDD) is weighted equally. If the Market Capitalization of an Index Component is below 250 Million USD or the average daily trading volume is below 350,000 USD as of the corresponding Selection Day, the Index Component will be capped at 2.5%. Any excess weight will be allocated equally to all uncapped Index Components.

- New Wording:

On each Adjustment Day each Index Component of the Solactive 3D Printing Index (SOLDDD) is weighted equally. If the Market Capitalization of an Index Component is below 250 Million USD or the average daily trading volume is below 600,000 USD as of the corresponding Selection Day, the Index Component will be capped at 2.5%. Any excess weight will be allocated equally to all uncapped Index Components.

Section 2.2 Ordinary adjustment:

- Old Wording:

The composition of the Index is ordinarily adjusted twice a year at the close of trading on the third Friday in March and September over a period of ten Business Days. If this happens to be no Business Day the adjustment is conducted on the preceding Business Day.

The composition of the Solactive 3D Printing Index (SOLDDD) is reviewed (see 2.1) on the Selection Day and the appropriate decision made is announced.

The first adjustment will be made in September 2013 based on the Trading Prices of the Index Components on the Adjustment Day.

Solactive AG shall publish any changes made to the Index composition on the Selection Day and consequently with sufficient notice before the Adjustment Day.

- New Wording:

The composition of the Index is ordinarily adjusted twice a year at the close of trading on the third Friday in March and September over a period of ten Trading Days. If this happens to be no Trading Day the adjustment is conducted on the next Trading Day.

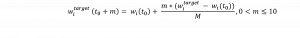

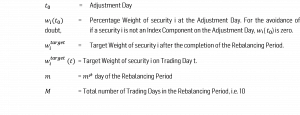

The Index is rebalanced twice a year over a ten-day period to ensure that rebalance transactions stay below the Average Daily Value Traded. Beginning on the Trading Day immediately following the Adjustment Day, and continuing over the next 9 Trading Days, defined as the Rebalancing Period, the target weights of the constituents of the Index on the 𝑚𝑡ℎ day are set as follows:

The composition of the Solactive 3D Printing Index (SOLDDD) is reviewed (see 2.1) on the Selection Day and the appropriate decision made is announced.

The first adjustment will be made in September 2013 based on the Trading Prices of the Index Components on the Adjustment Day.

Solactive AG shall publish any changes made to the Index composition on the Selection Day and consequently with sufficient notice before the Adjustment Day.

Section 4. Definitions:

> Selection Pool

- Old Wording:

“Selection Pool” in respect of a Selection Day are those companies that fulfill the following conditions:

(a) Significant business operations in the 3D printing industry (hardware or software).

(b) Listing on a regulated stock exchange in the form of shares tradable for foreign investors without

restrictions.

(c) Market Capitalization of at least 50 million USD.

(d) Average daily trading volume of at least 250,000 USD in the last three months for new Index Components.

(e) Average daily trading volume of at least 150,000 USD in the last three months for a current Index Component.

- New Wording:

“Selection Pool” in respect of a Selection Day are those companies that fulfill the following conditions:

(a) Significant business operations in the 3D printing industry (hardware or software).

(b) Listing on a regulated stock exchange in the form of shares tradable for foreign investors without restrictions.

(c) Market Capitalization of at least 50 million USD.

(d) Average daily trading volume of at least 1,000,000 USD in the last three months for new Index Components.

(e) Average daily trading volume of at least 500,000 USD in the last three months for a current Index Component.

> Trading Day

- Old Wording:

A “Trading Day” is in relation to the Index or an Index Component a Trading Day on the Exchange (or a day that would have been such a day if a market disruption had not occurred), excluding days on which trading may be ceased prior to the normal Exchange closing time. The Index Calculator is ultimately responsible as to whether a certain day is a Trading Day with regard to the Index or an Index Component or in any other connection relating to this Index Manual.

- New Wording:

“Trading Day” is with respect to an Index Component included in the Index at the Rebalance Day and every Index Component included in the Index at the Calculation Day immediately following the Rebalance Day (for clarification: this provision is intended to capture the Trading Days for the securities to be included in the Index as new Index Components with close of trading on the relevant Exchange on the Rebalance Day) a day on which the relevant Exchange is open for trading (or a day that would have been such a day if a market disruption had not occurred), excluding days on which trading may be ceased prior to the scheduled Exchange closing time and days on which the Exchange is open for a scheduled shortened period. The Index Administrator is ultimately responsible as to whether a certain day is a Trading Day.

> Adjustment Day

- Old Wording:

“Adjustment Day” is the third Friday in March and September. If this happens to be no Business Day, the Adjustment Day is the immediately preceding Business Day.

- New Wording:

“Adjustment Day” is the third Friday in March and September. If this happens to be no Trading Day, the Adjustment Day is the immediately preceding Trading Day.

Additionally, the following Definition will be added to Section 4

“Rebalance Period” is the period starting from (and including) the ADJUSTMENT DAY until and (including) the immediately following 10 Trading Days. The entire Rebalance Period lasts for 10 Trading Days.