Methodology Change | Several Solactive Thematic Indices | Effective Date 18/05/2023

Today, on 05/05/2023, Solactive announces the following changes to the methodology of the following indices (the ‘Affected Indices’). The changes to the methodology will become effective on 18/05/2023.

| NAME | RIC | ISIN |

| Solactive Battery Value-Chain Index | .SOLBATT | DE000SLA33F4 |

| Solactive Clean Energy Index NTR | .SOLCLNEN | DE000SL0AVN3 |

| Solactive Clean Energy Index PR | .SOLCLNEP | DE000SL0AVM5 |

| Solactive Clean Energy Index TR | .SOLCLNET | DE000SL0AVP8 |

| Solactive Clean Water Index NTR | .SOLWATR | DE000SLA6Z81 |

| Solactive Clean Water Index PR | .SOLWATRP | DE000SLA8HB9 |

| Solactive Clean Water Index TR | .SOLWATRT | DE000SLA8HC7 |

| Solactive Digital Payments Index NTR | .SOLDPAY | DE000SL0BRN9 |

| Solactive Digital Payments Index PR | .SOLDPAYP | DE000SL0BRM1 |

| Solactive Digital Payments Index TR | .SOLDPAYT | DE000SL0BRP4 |

| Solactive eCommerce Logistics Index | .SOLECOM | DE000SLA33G2 |

| Solactive Emerging Cyber Security Index NTR | .SOECYBSN | DE000SL0F799 |

| Solactive Emerging Cyber Security Index PR | .SOECYBSP | DE000SL0F781 |

| Solactive Emerging Cyber Security Index TR | .SOECYBST | DE000SL0F8A1 |

| Solactive EPIC Optical Technology & Photonics Index NTR | .SOLAZRN | DE000SL0E2G2 |

| Solactive EPIC Optical Technology & Photonics Index PR | .SOLAZRP | DE000SL0E2F4 |

| Solactive EPIC Optical Technology & Photonics Index TR | .SOLAZRT | DE000SL0E2H0 |

| Solactive Hydrogen Economy Index GTR | .SOHYDROT | DE000SL0B9F2 |

| Solactive Hydrogen Economy Index NTR | .SOHYDRON | DE000SL0B9E5 |

| Solactive Hydrogen Economy Index PR | .SOHYDROP | DE000SL0B9D7 |

| Solactive L&G Global Thematic Index NTR | .SOLGGTDN | DE000SL0FRT7 |

| Solactive L&G Global Thematic Index PR | .SOLGGTDP | DE000SL0FRS9 |

| Solactive L&G Global Thematic Index TR | .SOLGGTDT | DE000SL0FRU5 |

| Solactive Pharma Breakthrough Value Index | .SOLBIOT | DE000SLA30N4 |

Rationale for Methodology Change

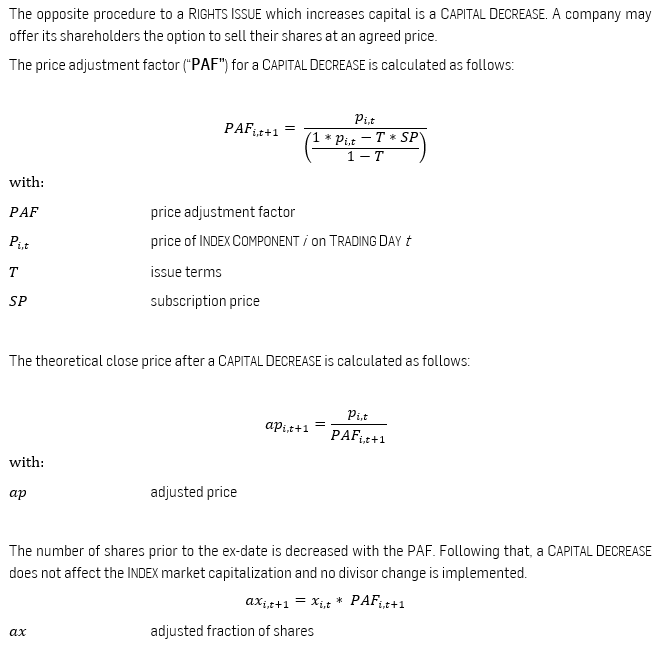

Solactive has determined that a modification to the treatment of rights issues and capital decreases from the standard logic defined in the Equity Index Methodology to a weight-neutral implementation of rights issues and capital decreases, is an improvement for certain concentrated indices, in particular for thematic and equally weighted indices, as it will help with the replication of a fund or respective an ETF portfolio. Currently, the indices would treat rights issues and capital decreases in a non-weight-neutral way. The instrument shares within the index are adjusted according to the terms. The ex-post shares multiplied by the adjusted price lead to a higher market capitalization within the index and therefore a higher weighting relative to the other index constituents. With a weight-neutral treatment, the weight and the index divisor remain unchanged. In order to achieve this, the number of shares within the index is adjusted by the (inverse of the) price adjustment factor as opposed to increasing them by the terms.

Changes to the Index Guideline

The following changes will be implemented in the following points of the Index Guideline:

Update to the section:

4.4. CORPORATE ACTIONS

Adjustments to the Index to account for corporate actions will be made in compliance with the Equity Index Methodology with the exception of section 2.1.4 (Rights Issue) and section 2.1.5 (Capital Decrease), which is available on the Solactive website: https://www.solactive.com/documents/equity-index-methodology/. This document contains for each corporate action a brief definition and specifies the relevant adjustment to the Index variables. For Rights Issues and Capital Decreases the treatment described in sections 4.4.1 and 4.4.2 applies

Addition of the sub-sections:

4.4.1 RIGHTS ISSUE (CAPITAL INCREASE)

Additions to:

6. DEFINITIONS

“Capital Decrease” shall have the meaning as defined in Section 3 of the Equity Index Methodology, which is available on the Solactive website: https://www.solactive.com/documents/equity-index-methodology/.

“Rights Issue” shall have the meaning as defined in Section 3 of the Equity Index Methodology, which is available on the Solactive website: https://www.solactive.com/documents/equity-index-methodology/.

The Uploaded guidelines will be posted to the website on 18th May 2023.