Hong Kong Newly Listed Equities Index

The bustling city of Hong Kong has long been a nexus for international trade, a vibrant cultural melting

pot, and an important financial hub. Moreover, strategic reforms enacted by the HKEX in 2018 unlocked

the gateway for emerging, innovative companies to go public, propelling Hong Kong to its status as a

leading center for IPOs. Read on for a quick dive into the blossoming attractiveness of Hong Kong’s IPO

market, and for an introduction to the Solactive Hong Kong Newly Listed Equities Index!

Why Even Invest in IPOs: Pros and Hurdles

Excluding the ‘excitement factor’, it all boils down to growth opportunities: IPOs provide a unique chance to invest at the ground level in companies that could be the next big thing. From biotech startups with cutting-edge solutions to green technology firms paving the way for a sustainable future, IPOs represent immense growth potential. On the other side, it’s important not to forget that IPOs also carry some risks: high volatility, lack of historical data for analysis, and potential overvaluation due to hype. Still, volatility goes both ways, and an IPO can generate explosive growth that established companies simply cannot achieve. Yet, there are some silent hurdles with regard to taking a company public: such companies tend to not be profitable yet, and many have weighted voting rights and dual-class share structures reflecting their fast-growing nature and the founders’ desire to retain influence – making an initial listing very difficult to achieve in some markets.

The Attractive Regulatory Framework of HKEX

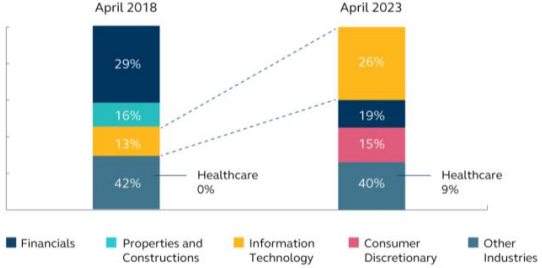

Aiming to overcome such hurdles and create a robust, appealing new regulatory framework, the Hong Kong Exchange (HKEX) rolled out three new listing chapters in 2018: 18A for pre-revenue biotech firms, 8A for issuers with weighted-voting rights, and 19C for secondary listings of overseas issuers. These reforms have had a profound impact on the market, diversifying it substantially. Notably, an influx of companies from healthcare and IT sectors have made their public debut in Hong Kong. Since the 2018 reforms, 260 new economy firms have listed in Hong Kong, raising an impressiveHK$916.5 billion.

The Way Forward: the Rise of AI and Green Tech

The aforementioned new listings have triggered a rise in the quantity and variety of new economy-related investment products, cultivating a burgeoning new economy ecosystem coupled with an expanded investor base and broader sell-side analyst coverage. In other words, the 2018 reforms have positioned Hong Kong as a global front-runner in financing and fostering the growth and development of new economy enterprises. Moving forward, HKEX identifies an opportunity for growth in specialist technology sectors, particularly in industries like AI-driven language models and renewable energy sources. The demand from investors for such sectors is substantial. However, many of these innovative companies are in their early stages, needing funding and yet to meet the existing HKEX Main Board eligibility criteria. Addressing this issue, HKEX has introduced the new 18C Specialist Technology chapter. The revised listing rules

now enable issuers from five distinct sectors – advanced IT, hardware, materials, new energy, environmental protection, and food and agricultural technologies – to go public in Hong Kong. The 18C Specialist Technology regime’s introduction is aptly timed, with an anticipation of a rich influx of specialist tech companies in the future. These reforms showcase the potential of well-structured changes that align with macro business and investor trends, all while preserving market quality and investor protections. All this is to say that Hong Kong, a blend of Eastern and Western influences, is poised for an exhilarating future. Being at the core of the Greater Bay Area (GBA), it’s envisaged to be the financial hub for the GBA’s tech powerhouse, a vibrant hub of innovation and advanced manufacturing, and an ideal launchpad for specialist tech firms.

The Anticipated Revival of a Stagnating Market

Hong Kong’s stock market struggled in 2022, largely due to global inflation, rising rates, Beijing’s Covid strategy, and the local property market slump. This trend continued into 2023 with a slow first quarter, hosting 18 IPOs that raised HK$6.6 billion ($840 million), a 51% drop in value despite a 20% increase in volume compared to the same period the previous year. Even so, Hong Kong represented the 5th largest listing destination globally by funds raised in 1Q23.

Despite the sluggish start, analysts from Deloitte China, EY, and KPMG are optimistic about a turnaround in 2023. They anticipate the complete reopening of Chinese and Hong Kong borders, relaxed listing rules, and upcoming IPOs of Alibaba’s business units to revive the market. In

March, Hong Kong reduced the market capitalization threshold for advanced tech companies to list. Alibaba’s decision to break into six separate units, each pursuing individual listings, suggests easing governmental control over tech giants, expected to lift the Hong Kong

stock exchange. Despite not confirming these plans, it’s reported that Alibaba’s logistics and grocery business units are among the firstto go public. Experts believe the market’s current state is improved compared to Q4 of 2022, and they predict further enhancement from September to December 2023. They anticipate the end of U.S. interest rate hikes and a shift in funds’ investment strategies towards high-growth Asian regions, like China, will boost the Hong Kong IPO market in the second half of 2023. Deloitte’s Capital Market Services Group projects about 110 new listings in Hong Kong for 2023, raising approximately HK$230 billion ($29 billion).

The Solactive Hong Kong Newly Listed Equities Index

Methodology in a Nutshell

The index encompasses recently IPO-ed securities

listed on the Main Board of the Hong Kong Stock

Exchange, excluding SPACs. The index universe is formed from securities meeting specific criteria:

- a minimum Average (as well as median) Daily Value

Traded (ADV) of HKD 10 million over the previous 1

month relative to the selection day - a minimum Market Capitalization of HKD 1 billion as of

the selection day, - and a free float percentage of at least 25% (or 15% if

the Market Capitalization is over HKD 10 billion).

Furthermore eligible securities should have a maximum of 10 non-trading days in the past 3 months. The index is rebalanced quarterly, incorporating securities with IPOs or newlistings within the last 756 business days, aiming for a total 50 securities based on free float market capitalization. The index also undergoes monthly IPO reviews to include recent IPOs, subject to liquidity and market capitalization criteria. Each component’s weight is assigned proportionally to

its free float market capitalization, capped at 10%, with illiquid stocks receiving proportionally lower weight caps.

The Solactive Hong Kong Newly Listed Equities Index

Index Characteristics

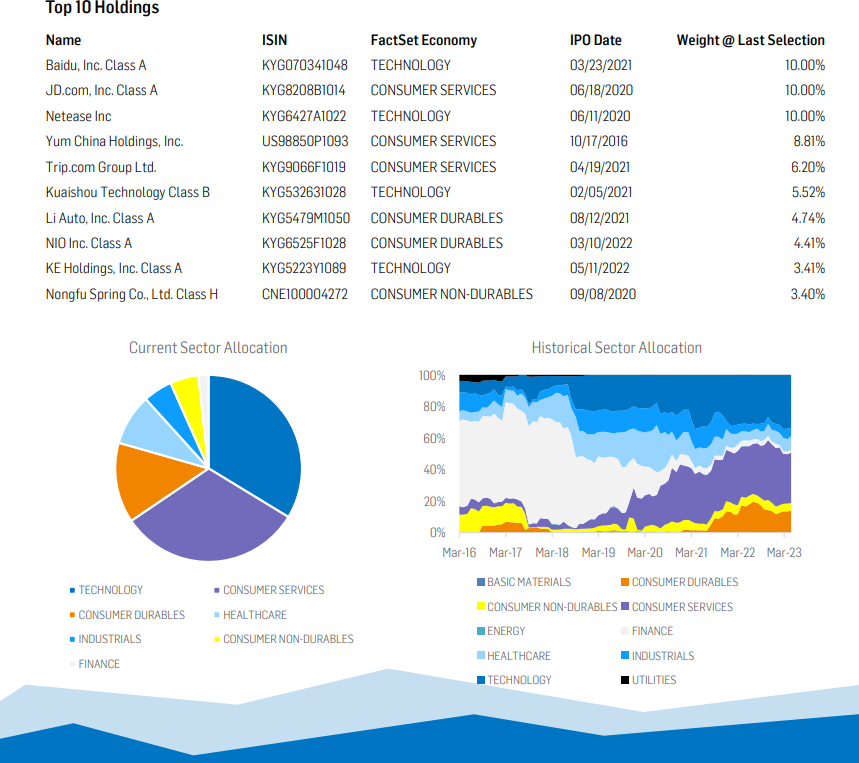

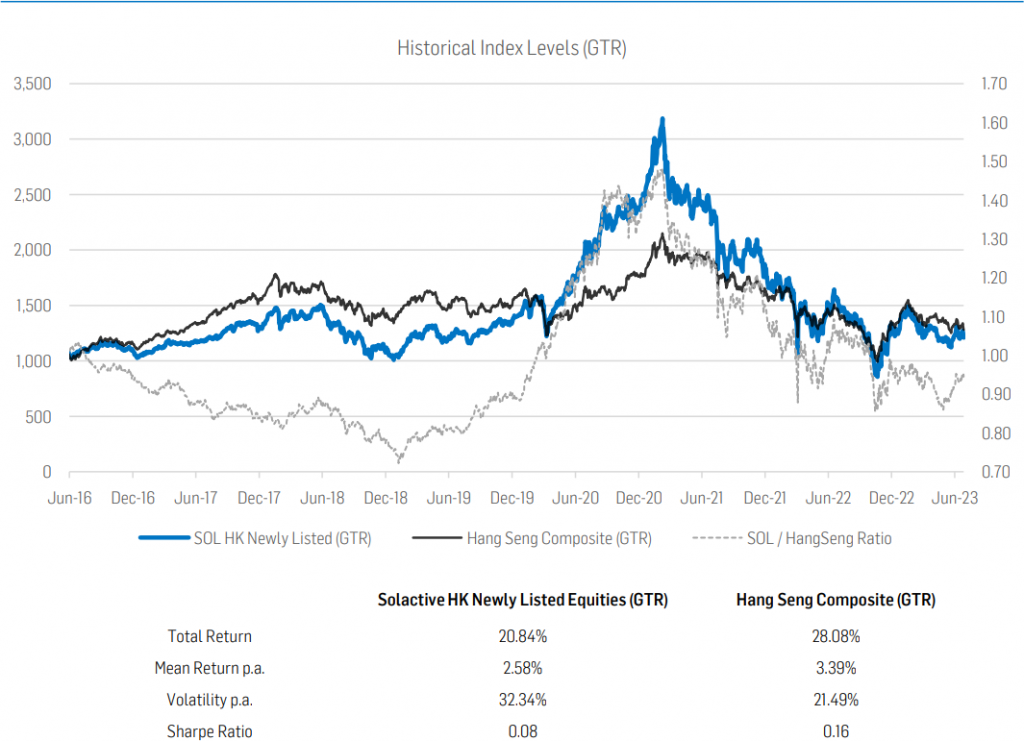

As previously discussed, the index has shown relatively higher volatility, greatly outperforming the broader market in 2020 but also enduring more severe subsequent downturns. While it has lagged slightly behind the broader market since its inception to date, yielding an annual return of 2.58% compared to 3.39%, it’s now on an upward trajectory, as indicated by the rapidly climbing relative performance ratio in 2023. The effect of the HKEX reforms can be seen in the shift in historical sector allocation; previously heavily leaning towards finance stocks, the index now predominantly features sectors like Technology (with key players such as Baidu, Netease, and Kuaishou), Consumer Services (particularly e-commerce titan Jingdong), and consumer durables (including next-gen EV companies like NIO and Li Auto).