ESMA Naming Guidelines

In response to the European Securities and Markets Authority's (ESMA) recent guidelines on ESG fund naming, which officially came into effect on 21 November 2024, we are pleased to announce the launch of two new Index series:

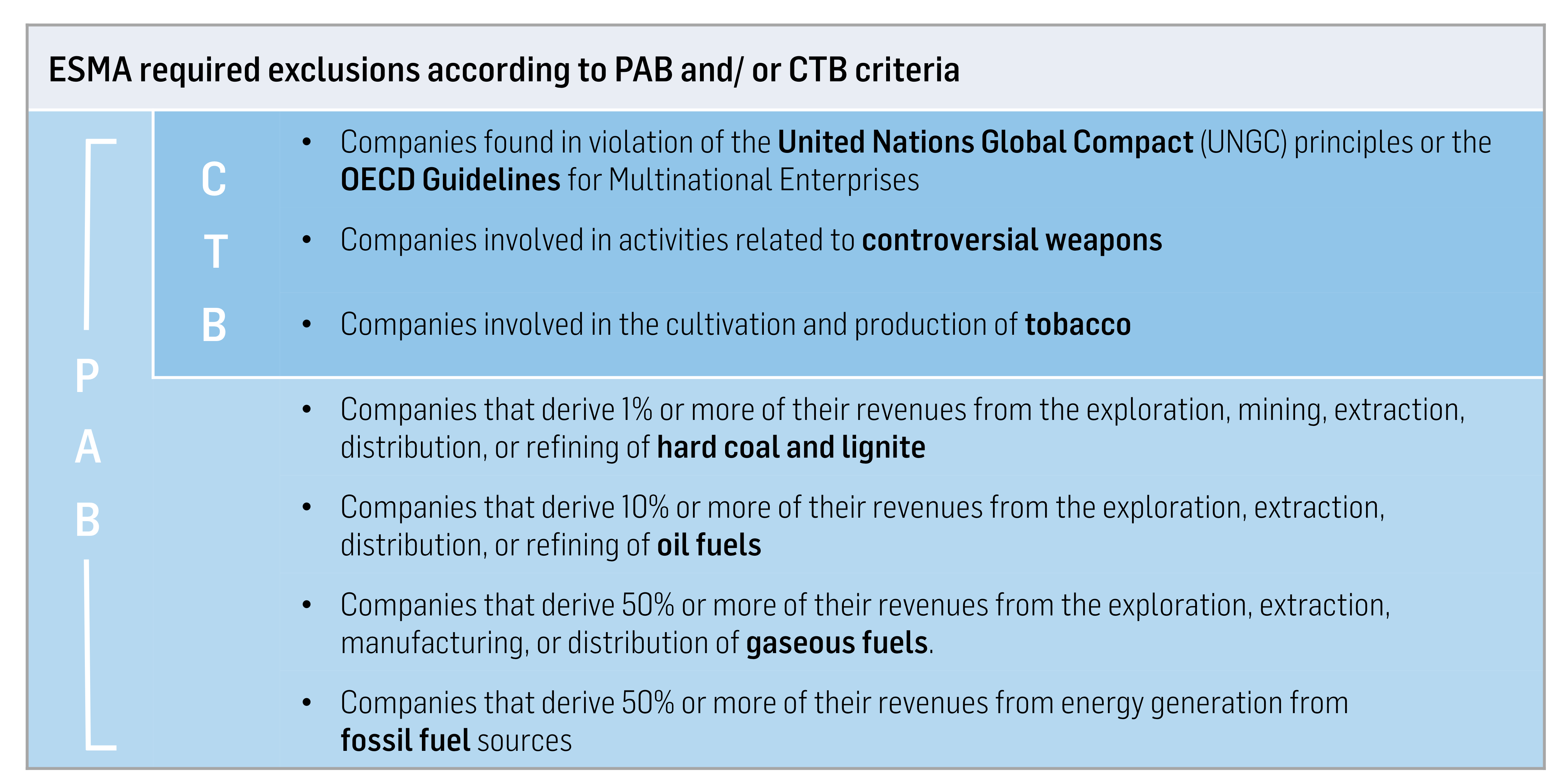

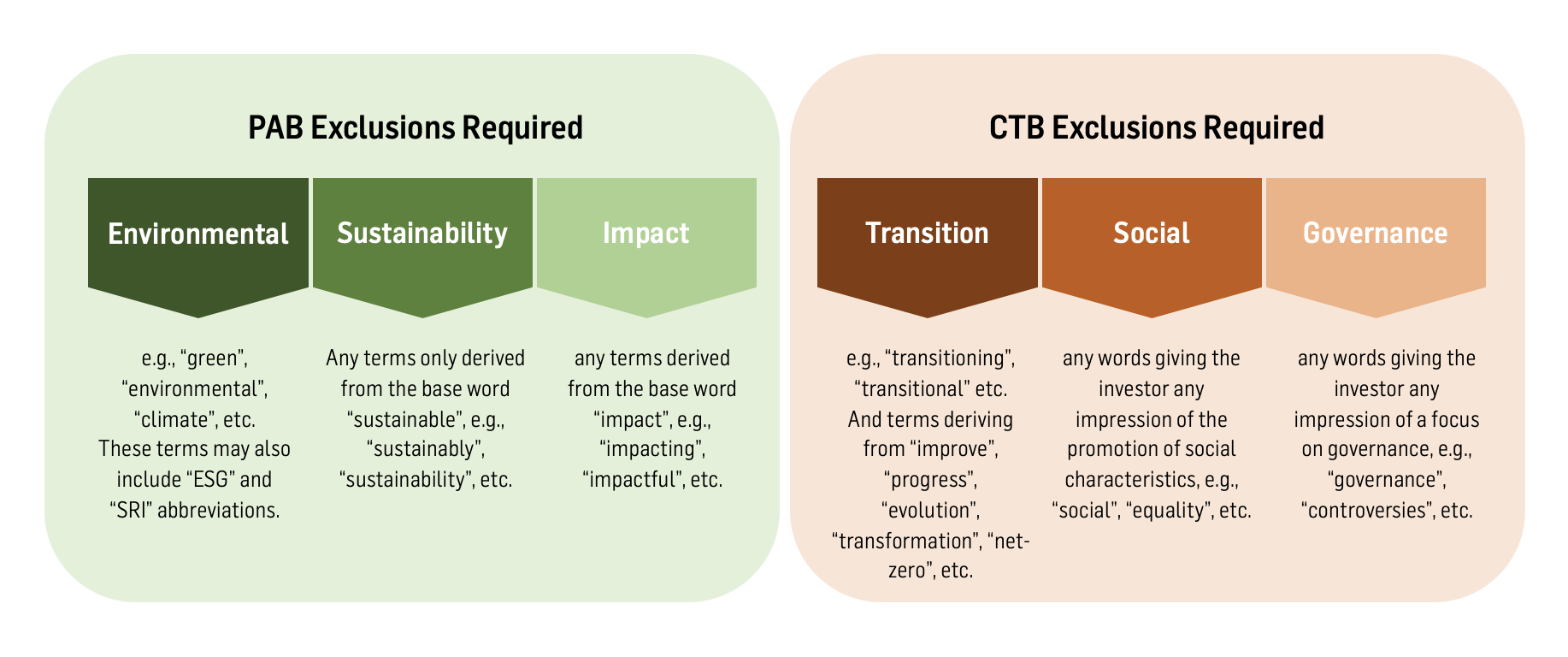

These series aim to follow the ESMA Guidelines and provide a foundation for ESG-conscious investment. Specifically, they apply the core exclusions of Paris-Aligned Benchmarks (PAB) and Climate-Transition Benchmarks (CTB), while allowing for further tailored layers. Both universes are derived from our Solactive GBS Global Markets All Cap Index. Thus, carve outs for countries, regions, and markets are available as well. On top, any additional criteria can be integrated – from custom decarbonization pathways to any proprietary exclusion lists.

In essence, this flexible approach offers a core framework adaptable to unique sustainability objectives.

1.What are the new ESMA guidelines about?

The new ESMA guidelines regulate the use of ESG (Environmental, Social, and Governance) and sustainability-related terms in fund names to ensure transparency and prevent greenwashing. They set standards for how these terms can be used and require funds to demonstrate measurable ESG impacts.

2. What is the new ESMA guidelines’ timeline?

The guidelines came into effect three months after they were translated into all EU official languages, on November 2024. Existing funds have an additional six months to comply, making the final compliance date for existing funds 21st May 2025.