Methodology change | Solactive Wealthsimple Socially Responsible Factor Indices | Effective Date 15 July 2022

Today, on the 14th of July 2022, Solactive announces the following changes to the methodology of the following indices (the ‘Affected Indices’):

| NAME | RIC | ISIN |

| Solactive Wealthsimple DM ex NA Socially Responsible Factor Index NTR | .SOLDSRFN | DE000SLA9899 |

| Solactive Wealthsimple DM ex NA Socially Responsible Factor Index PR | .SOLDSRFP | DE000SLA9881 |

| Solactive Wealthsimple DM ex NA Socially Responsible Factor Index TR | .SOLDSRFT | DE000SLA99A6 |

| Solactive Wealthsimple North America Socially Responsible Factor Index NTR | .SOLNARFN | DE000SLA9865 |

| Solactive Wealthsimple North America Socially Responsible Factor Index PR | .SOLNARFP | DE000SLA9857 |

| Solactive Wealthsimple North America Socially Responsible Factor Index TR | .SOLNARFT | DE000SLA9873 |

Rationale for Methodology Change

The Indices are designed to select certain securities based on a multi-factor score that includes a value score. Solactive decided to adjust the ratios defining the value formula.

Additionally, to increase data coverage and broaden the universe previous quarter data will be taken into account in case of missing quarterly fundamental data points.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline:

Section 2.2: Selection of the Index Components

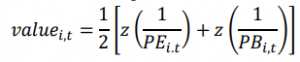

The value formula will be changed to the following:

Section 2.2: Selection of the Index Components

The following definitions will be added:

In case of negative earnings the PE ratio is set equal to a value of -1. Securities with a negative book value of equity are excluded. All fundamental data points are as of last fiscal quarter. In case such data is not available the data as of previous quarter is used.

Defined terms used in this announcement, but not defined herein, have the meaning assigned to them in the respective index guideline of the Affected Indices.