Methodology Change | Solactive Global SuperDividend™ REIT Index | Effective Date 22/01/2021

Today, on the 18/01/2021, Solactive announces the following changes to the methodology of the following indices (the ‘Affected Indices’):

|

Index Name |

Index RIC |

Index ISIN |

|

Solactive Global SuperDividend™ REIT Index |

.SRET |

DE000SLA0VW3 |

|

Solactive Global SuperDividend™ REIT Index (Price) |

.SRETP |

DE000SLA0VY9 |

Rationale for methodology change

In order to react to the high turnover observed in the recent quarterly reviews and to ensure that rebalance transactions stay on a moderate Average Daily Trading Volume, Solactive has determined to make changes to the rebalance period as follows.

Changes to the Index Guideline

The index rebalance period will be changed from a one-day-rebalance to a multi-day-rebalance over a five-day weight implementation period, beginning on the Rebalance Day and continuing until the fourth Trading Day following the Rebalance Day.

The following sections of the Methodology are affected:

- Section 1.5 WEIGHTING

OLD:

On each ADJUSTMENT DAY each INDEX COMPONENT of the Solactive Global SuperDividend™ REIT Index is weighted equally

NEW:

On each ADJUSTMENT DAY each INDEX COMPONENT is weighted equally after a five-day period as described in section 2.2..

On each DIVIDEND CUT ADJUSTMENT DAY, the company that is added to the index composition at the quarterly review dates will be given the same target weight as the member that will be deleted, calculated based on the DIVIDEND CUT REVIEW DAY. In case more than one company is deleted, the cumulative weight of these companies is calculated and equally distributed among the replacements. Companies that remain in the index will receive a target weight based on the weight as of the DIVIDEND CUT REVIEW DAY. Target weights will be implemented after a five-day period as described in section 2.2..

- Section 2.2 ORDINARY ADJUSTMENT

From (old version):

The composition of the Index is ordinarily adjusted once a year on the last BUSINESS DAY in January. The composition of the Index is reviewed on the SELECTION DAY and the appropriate decision made is announced.

The first adjustment will be made in January 2016 based on the Trading Prices of the INDEX COMPONENTs on the ADJUSTMENT DAY.

SOLACTIVE will publish any changes made to the INDEX COMPONENTS with sufficient notice before the REBALANCE DAY on the SOLACTIVE webpage under the section “Announcement”, which is available at https://www.solactive.com/news/announcements/.

To (new version):

The composition of the Index is ordinarily adjusted once a year starting on the last BUSINESS DAY in January (ADJUSTMENT DAY). The composition of the Index is reviewed on the SELECTION DAY and the appropriate decision made is announced.

Additionally, the composition of the index is adjusted quarterly starting on the last BUSINESS DAY in April, July and October (“DIVIDEND CUT ADJUSTMENT DAY”), in case any changes need to be implemented identified on the DIVIDEND CUT REVIEW DAY as described in Section 2.1..

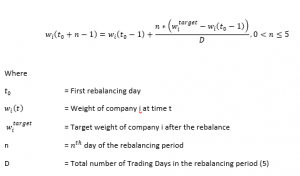

The Index is rebalanced quarterly over a five-day period (“Rebalance Period”). Beginning on the ADJUSTMENT DAY/DIVIDEND CUT ADJUSTMENT DAY, and continuing until the fourth TRADING DAY following the ADJUSTMENT DAY/DIVIDEND CUT ADJUSTMENT DAY, the weights of the constituents of the index on the nth day are set as follows:

For more information on the rebalance procedure please refer to the Equity Index Methodology, which is incorporated by reference and available on the Solactive website: https://www.solactive.com/documents/equity-index-methodology/.

Solactive will publish any changes made to the Index Components with sufficient notice before the ADJUSTMENT Day on the Solactive webpage under the section “Announcement”, which is available at https://www.solactive.com/news/announcements/.

- Section 6 DEFINITIONS

Section 6 will be expanded as follows:

“DIVIDEND CUT ADJUSTMENT DAY” is the last BUSINESS DAY in April, July and October. If the last BUSINESS DAY in April, July and October is not a TRADING DAY, then the rebalance is postponed to the following TRADING DAY.

“DIVIDEND CUT REVIEW DAY” is 5 BUSINESS DAYs before the last BUSINESS DAY in April, July and October.