UPDATE | Methodology Change | Solactive Digital Payments Index | Effective Date 3rd March 2022

Today, on 25.02.2022, Solactive announces an update to the below announcement published on 24.02.2022.

The update in Section 2.1 Index Universe Requirements is as follows:

Announced Text:

[…]

3. On each SELECTION DAY, any company included in the ESG Exclusions Index as determined by SOLACTIVE is then excluded from the INDEX UNIVERSE. Further, any company that is not a part of the INDEX UNIVERSE of the ESG Exclusions Index as of the immediately preceding SELECTION DAY of the ESG Exclusions Index, shall be excluded from the INDEX UNIVERSE.

The ESG Exclusions Index is reconstituted by SOLACTIVE on a semi-annual basis and the

methodology by reference to which the ESG Exclusions Index is constructed, together with the most recent applicable categories and inclusion criteria, is available on the Solactive website.

The applicable categories and inclusion criteria of the ESG Exclusions Enhanced Index as of 28th of February 2022 are set out in ANNEX B of this document.

Updated text:

[…]

3. On each SELECTION DAY, any company included in the ESG Exclusions Enhanced Index as determined by SOLACTIVE is then excluded from the INDEX UNIVERSE. Further, any company that is not a part of the INDEX UNIVERSE of the ESG Exclusions Enhanced Index as of the immediately preceding SELECTION DAY of the ESG Exclusions Enhanced Index, shall be excluded from the INDEX UNIVERSE.

The ESG Exclusions Enhanced Index is reconstituted by SOLACTIVE on a semi-annual basis and the methodology by reference to which the ESG Exclusions Enhanced Index is constructed, together with the most recent applicable categories and inclusion criteria, is available on the Solactive website.

The applicable categories and inclusion criteria of the ESG Exclusions Enhanced Index as of 28th of February 2022 are set out in ANNEX B of this document.

The methodology changes will become effective on 03.03.2022.

——————————————————————————————————————–

Today, on the 24th of February 2022, Solactive announces the following changes to the methodology of the following indices (the ‘Affected Indices’):

|

NAME |

RIC |

ISIN |

| Solactive Digital Payments Index NTR |

.SOLDPAY |

DE000SL0BRN9 |

| Solactive Digital Payments Index PR |

.SOLDPAYP |

DE000SL0BRM1 |

| Solactive Digital Payments Index TR |

.SOLDPAYT |

DE000SL0BRP4 |

Rationale for Methodology Change

The Indices aim to track the performance of a basket of stocks of companies that are actively engaged in the international clean water industry through the provision of technological, digital, engineering, utility and/or other services.

As per the current selection process of Indices, the companies on the Future Protection List (the “FWPL”) provided by Legal & General Investment Management (“LGIM”) are not included as the Index Components. The FWPL includes companies which meet any of the following criteria:

- Involvement in the manufacture and production of controversial weapons,

- Perennial violators of the United Nations Global Compact (UNGC),

- Involvement in mining and extraction of thermal coal

Solactive has determined that the methodology of the Indices shall be amended to enhance the ESG activity screens from the existing FWPL to a more restrictive exclusion list. The suggested enhanced list will screen the companies on all of the above criteria as well as additional activities. A more detailed overview of the considered activities can be found below in section “Proposed Changes to the Index Guideline”.

Additionally, to ensure investability of the Indices as well as reflect the actual liquidity available in the market, the weighting concept is proposed to be amended.

Changes to the Index Guideline

The following Methodology changes will be implemented in the following points of the Index Guideline:

Section 2.1 Index Universe Requirements

Old text:

[…]

3. Any company listed on the Future Protection List (the “FWPL”) produced by Legal & General Investment Management (“LGIM”) are then excluded. The FWPL is reconstituted by LGIM on a semi-annual basis and the methodology by reference to which the FWPL is constructed is published on Future World Protection List Methodology which is available on the following website: https://www.lgim.com/landg-assets/lgim/_document-library/capabilities/future-world-protection-list-public-methodology.pdf. The most recently published FWPL that is available on a respective SELECTION DAY is applied. It can be found on the following website: https://www.lgim.com/uk/en/capabilities/corporate-governance/tracking-esg-progress.

[…]

New text:

[…]

3. On each SELECTION DAY, any company included in the ESG Exclusions Index as determined by SOLACTIVE is then excluded from the INDEX UNIVERSE. Further, any company that is not a part of the INDEX UNIVERSE of the ESG Exclusions Index as of the immediately preceding SELECTION DAY of the ESG Exclusions Index, shall be excluded from the INDEX UNIVERSE.

The ESG Exclusions Index is reconstituted by SOLACTIVE on a semi-annual basis and the

methodology by reference to which the ESG Exclusions Index is constructed, together with the

most recent applicable categories and inclusion criteria, is available on the Solactive website.

The applicable categories and inclusion criteria of the ESG Exclusions Enhanced Index as of 28th of February 2022 are set out in ANNEX B of this document.

Section 2.3 Weighting of the Index Components

New text:

On each SELECTION DAY each INDEX COMPONENT is weighted in accordance with the following steps

I. Each Index Component is initially weighted equally 𝑤𝑖∗;

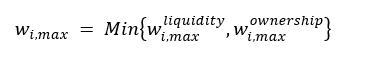

II. Then, for each Index Component the maximum weight 𝑤𝑖,𝑚𝑎𝑥 is calculated as:

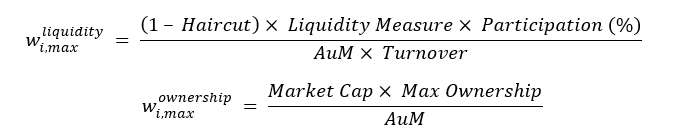

where,

Where:

AuM – the maximum of total assets under management in US Dollars of ETFs tracking the index as listed in Appendix C and USD 50 million;

Haircut – assumed 10%;

Liquidity Measure – 3-month USD Average Daily Value Traded;

Market Cap – the company full market capitalisation in USD;

Max Ownership – assumed 7.5%;

Participation (%) – assumed 100%;

Turnover – assumed 40%.

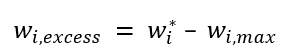

III. In respect of Index Components whose initial weight 𝑤𝑖∗ is greater than 𝑤𝑖,𝑚𝑎𝑥, the Target Index Weight 𝑤𝑖 shall be set to be equal to 𝑤𝑖,𝑚𝑎𝑥, and the excess weight is then calculated as follows:

The cumulative excess weight is then proportionally distributed across all Index Components whose initial weight 𝑤𝑖∗ is less than 𝑤𝑖,𝑚𝑎𝑥 such that the above maximum weight cap condition is fulfilled. This can be an iterative process until 100% weight is fully allocated and all conditions above are fulfilled.

Section 7: Definitions

The following definition will be included.

“Data Provider II” is Sustainalytics. For more information, please visit: www.sustainalytics.com.

Annex B

As of February 2022, the following inclusion criteria for the categories below were applicable.

Please refer to the most recent document available under the URL as specified in section ‘2.1. Index Universe Requirements’ above for the most recent applicable categories and inclusion criteria.

|

Categories |

Inclusion criterion |

|

Established norms around Environment, Human Rights, Corruption and Labour Rights |

Non-Compliance with the UNGC |

|

Controversy |

Controversies with the Level 5 |

|

Tobacco |

(5% Production <OR> 5% Retail <OR> 5% Related Products/Services)* |

|

Defense – Weapons |

(5% Military Contracting Weapons <OR> 5% Military Contracting Weapons – Related Products)* |

|

Defense – Controversial Weapons |

Any direct Involvement or any indirect Involvement through corporate ownership |

|

Small Arms |

(5% Civilian customers (Assault and non-assault weapons) <OR> 5% Key Components <OR> 5% Military/law enforcement customers <OR> 5% Retail/Distribution)* |

|

Coal |

(5% Thermal Coal Extraction <OR> 5% Power Generation <OR> 5% Supporting Products/Services <OR> Power Generation Capacity Increase)* |

|

Conventional Oil & Gas |

(5% Generation <OR> 5% Production <OR> 5% Supporting Products/Services <OR> Capacity Increase) * |

|

Unconventional Oil & Gas |

(5% Oil Sands Extraction <OR> 5% Artic Oil & Gas Exploration/Extraction <OR> 5% Shale Energy Extraction <OR> Capacity Increase)* |

|

Nuclear Power |

(5% Production <OR> 5% Distribution <OR> 5% Supporting Products <OR> Capacity Increase)* |

|

Alcohol |

(5% Production <OR> 5% Retail <OR> 5% Related Products/Services)* |

|

Gambling |

(5% Operations <OR> 5% Specialized Equipment <OR> 5% Supporting Products/Services)* |

|

Adult Entertainment |

(5% Production <OR> 5% Distribution)* |

|

Note: · % figures refer to revenue threshold (for degree of involvement). The criterion is fulfilled if involvement is equal to or above such threshold. · Capacity increase refers to any increase in capacity from the immediately preceding Selection Day of the ESG Exclusions Enhanced Index · The terminology used in the table above is specific to the Data Provider II and may change from time to time.

*this includes significant corporate ownership (were a company holds a stake greater than 50% in an involved company, the revenues of the involved company are attributed to the company). |

|

Any company which fulfills any of the criteria set out above shall be a component of the ESG Exclusions Enhanced Index. The primary listing for each company is selected as Index Component of the ESG Exclusions Enhanced Index. For the avoidance of doubt, any company for which an evaluation of the criteria is not possible due to the non-availability of relevant data from the Data Provider II, shall be a component of the ESG Exclusions Enhanced Index.

Annex C

Name of the ETF used to determine the AuM:

L&G Digital Payments UCITS ETF, ISIN: IE00BF92J153