Hidden Champions in the Solactive Mittelstand & MidCap Deutschland Index

|

Germany has been gradually embracing and benefiting from a profound integration into the global value chain. While its high degree of openness disproportionally exposes the largest economy in Europe to a worldwide crisis like COVID-19, Germany has contained the coronavirus relatively well with its pragmatic response and is gearing up in advance to gain the upper hand in a global economic recovery. Instead of renowned large-caps, our Solactive Mittelstand & MidCap Deutschland Index invests in made-in-Germany mid-sized companies which are well established in diverse niche fields. This set of ambitious hidden champions has outperformed its larger counterpart in the past, and is anticipated to further ride the wave of a potential post-pandemic recovery. |

MTTLSTRN Index: Exposure to “Made-in-Germany” MidCaps

Have you recently wondered whether the stamp “made-in-Germany” still has its justification as a signal of quality? A look at the hidden champions within the Solactive Mittelstand & MidCap Deutschland Index may give an answer.

The index provides exposure to companies that are incorporated in Germany and have their primary listing on Xetra, with a free float market capitalization of at least EUR 200m. Banks, insurance companies and diversified financials are excluded from the selection universe. Further, the index excludes the top-30 companies according to free float market capitalization and aims at selecting the next 70 largest companies. As a result, the Mittelstand & MidCap Index offers an opportunity to invest in German hidden champions.

An interesting index feature is the “Free Float Correction Factor”. This factor increases the free float market capitalization that is used to rank the companies if equity holdings can be attributed to company founders or the management. Practically, this increases the weight of family-owned companies in the index. Further information regarding the index’s methodology can be found in the index guideline.

Both the exclusion of financials and the correction factor for family, founder, or management ownership seem to add stability and positive contribution to the index’s performance. In comparison with another well-known German benchmark for midcap companies, our Mittelstand & MidCap Index displays an outperformance of around 6 percentage points since the beginning of the year.

The German Backbone Leveraged by Global Opportunities

Germany is a highly exports-oriented economy. In 2018, its degree of openness – measured by imports plus exports in relation to GDP – was 87.2%, which is the highest number among all G7-nations.1 A representative example of how open the German economy is, could be the Solactive Germany 30 Index – our index tracking the price movements of the 30 largest German companies. The export share of total revenues of the index’s constituents is, on average, around 74% – ranging from 0% for Deutsche Wohnen to 97% for Fresenius Medical Care.

The average of 74% of total revenues that is generated outside of Germany links the performance of the 30 largest German companies tightly to the global economy. The same is true for companies composing the Solactive Mittelstand & MidCap Deutschland Index, but to a lesser extent. Around 63% of this index’s revenues are achieved outside of Germany, ranging from 0% for some real estate and telecommunications companies, to close to 100% for MorphoSys. With less than two thirds of its revenues being generated through business operations outside of Germany, the Mittelstand & MidCap Index is still exposed to the state of the global economy. At the same time, the more than a third of its revenues that is achieved domestically brings potentially a layer of resilience to its performance.

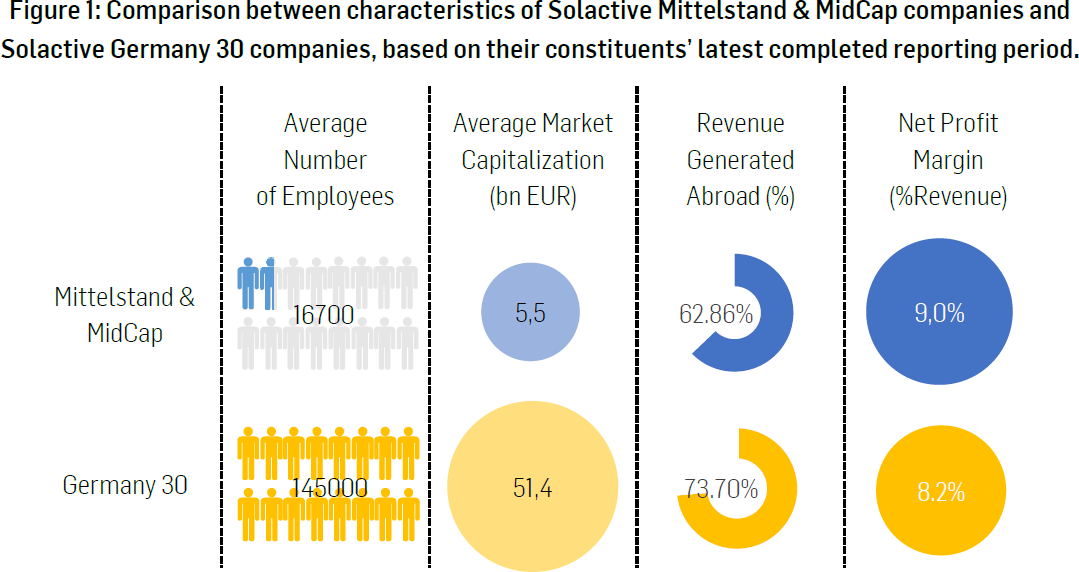

The characteristics of the companies in the Solactive Mittelstand & MidCap Deutschland Index make it very appealing to investors. With an average market capitalization of around EUR 5.5bn and an average number of employees of around 16,700, the index comprises well-established companies from the second tier. For a comparison, the corresponding figures for our index with the 30 largest German corporations are EUR 51.4bn and 145,000, respectively. The smaller, and potentially faster growing companies in the Mittelstand & MidCap Index, have a weighted average net profit margin of 9.0%, calculated by dividing annual net income by annual net sales (based on their constituents’ latest completed reporting period). Its bigger brother has a lower weighted average net profit margin of 8.2%.

Source: Solactive

Performance – Bigger Bang for the Buck

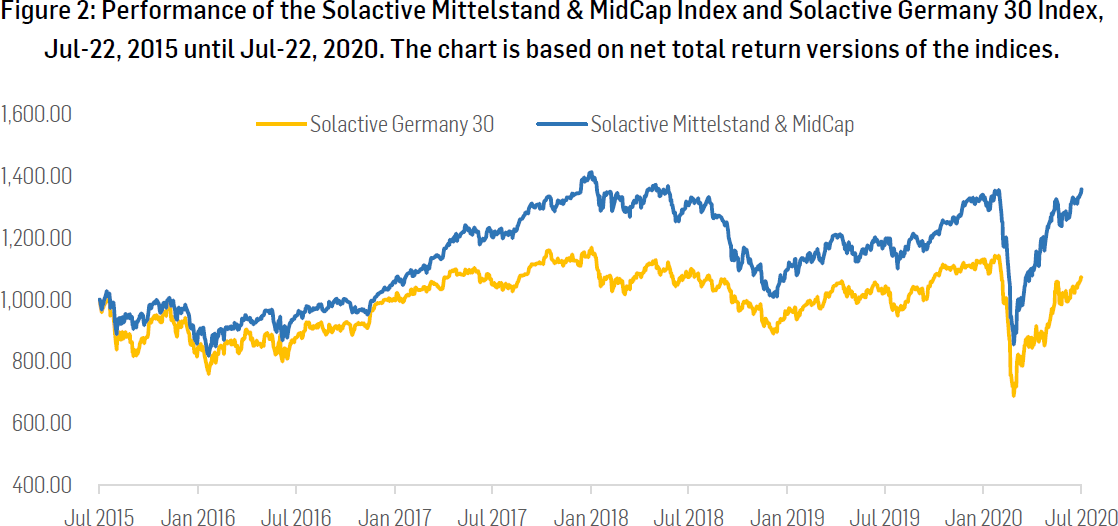

Since the beginning of the year, as well as over the last five years, the Solactive Mittelstand & MidCap Deutschland Index has outperformed the Solactive Germany 30 Index. The former returned 35.8% over the last five years, and 3.0% from the end of 2019 until July 22, 2020. The latter is lagging with 7.0% and -3.1%, respectively. These numbers are based on the net total return version of the indices.

The Mittelstand & MidCap Index’s strong outperformance of almost 29 percentage points over the last five years particularly stems from the indices’ difference in performance in 2017. During this year, the Mittelstand & MidCap Index returned 31.0%, whereas the Germany 30 Index lagged with 12.3%. In 2019 and 2020, this performance gap further increased by 6.8 and 6.1 percentage points, respectively.

Source: Solactive

At the same time, volatility was lower for the Mittelstand & MidCap Index. Over the last five years, this index’s annualized volatility stood at 18.7%. Interestingly, 2020 has depicted a similar picture thus-far. The index with the smaller companies has had a YTD volatility of 32.5%, and the top-30 index a 39.8% one. The reason for the lower standard deviation of returns could lie in the diversification effect of having more stocks in this index of around 70 titles – as well as the exclusion of certain financials.

Table 1: Summary statistics, Jul-22, 2015 until Jul-22, 2020. Based on net total return (EUR) versions of the indices.

|

|

Drawdown |

Total Return |

Return p.a. |

Volatility p.a. |

Sharpe Ratio |

|

Solactive Germany 30 Index |

-41,14% |

7,03% |

1,37% |

20,85% |

0.07 |

|

Solactive Mittelstand & MidCap Deutschland Index |

-39,50% |

35,80% |

6,30% |

18,67% |

0.34 |

Source: Solactive

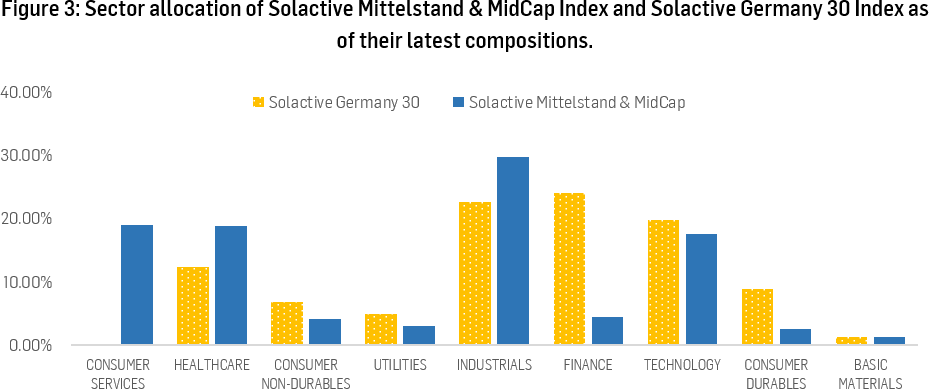

A sector breakdown of both indices reveals differing sector allocations. Banks, insurers, and diversified financials are excluded from the selection pool of the Mittelstand & MidCap Index. Other than that, the Mittelstand & MidCap Index tilts towards Industrials, followed by Consumer Services, Healthcare and Technology companies, whereas its bigger-sized counterpart weights Financials more heavily, but does not have an exposure to Consumer Services companies.

Source: Solactive

Individual Stocks – Hidden Champions and Niche Players

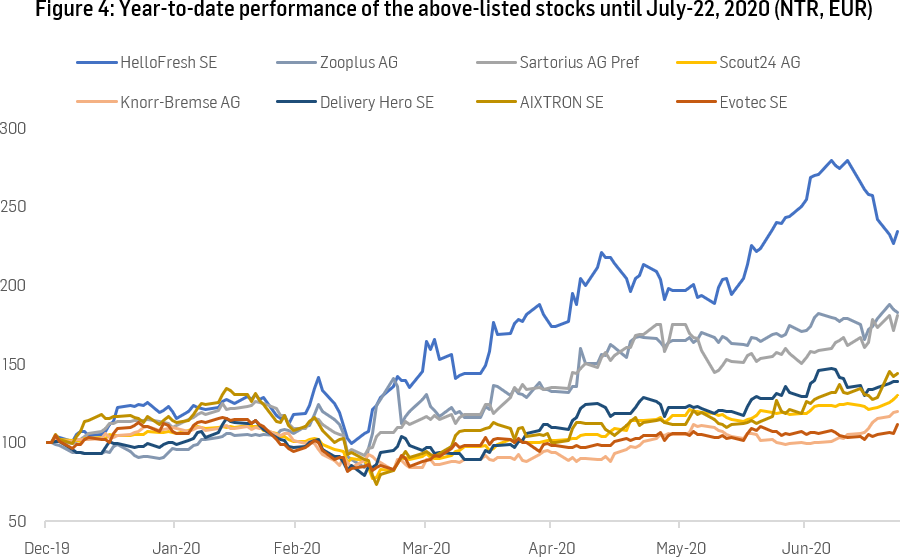

The best performing stocks since the end of last year in the Mittelstand & MidCap Index are HelloFresh (+133.9%), Zooplus (+82.7%), and Sartorius (+80.2%). In the following, we take a closer look at these companies, as well as other interesting stocks that are representative of the index (performance numbers in EUR terms between December-31, 2019 until July-22, 2020):

- HelloFresh SE: Founded in 2011 to deliver prepared meal kits filled with easy-to-implement recipes and all ingredients needed with local sources. HelloFresh is the global leader for the delivery of meal kits. It operates across 13 countries and has seen a 74% YoY growth in customer base in the second quarter 2020.2 YTD +133.9% (EUR).

- Zooplus AG: Founded in 1999, the Munich-based European-leading online retailer mainly provides pet food and accessories for all major pet breeds. With over 7 million active users, the e-commerce company’s sales volume hit EUR 1.5bn in 2019.3 YTD +82.7% (EUR).

- Sartorius AG: Founded in 1870, the biopharmaceutical and laboratory equipment supplier offers products ranging from biopharmaceutical manufacturing solutions, to laboratory instruments and services. Due to COVID-19, the company also begun supplying coronavirus testing and research products.4 Globally, Sartorius is the biggest supplier of specific biotech equipment. YTD +80.2% (EUR).

- Scout24 AG: Founded in 1998 as an operator of digital classified marketplaces and online advertisement platforms mainly focused on European markets (e.g., Scout24.com, ImmobilienScout24.de, and Autoscout24.com). YTD +29.4% (EUR).

- Knorr-Bremse AG: Founded in 1905, the traditional German manufacturer develops, and services braking systems for rail and commercial vehicles as the world’s number one supplier. The company is also one of the leading players in offering a wide range of safety-critical sub-systems. YTD +19.4% (EUR).

- Delivery Hero SE: Founded in 2011 to offer online food ordering and delivery services. Its number of orders almost doubled (+95% YoY) during this year’s second quarter.5 Delivery Hero is now one of the leading global food-delivery service providers. YTD +38.4% (EUR).

- AIXTRON SE: Founded in 1983, the company is a supplier of the semiconductor industry with expertise in deposition technology, which is applied in the manufacturing of electronic and opto-electronic components. AIXTRON is among the biggest suppliers of MOCVD equipment (metal organic chemical vapor deposition) YTD +43.4% (EUR).

- Evotec SE: Founded in 1993 to provide drug discovery and development solutions through external partnerships with various pharmaceutical and biotechnological companies, or academies, among others. The company is also advancing into the field of biotherapeutics through the acquisition of Just Biotherapeutics.6 YTD + 11.3% (EUR).

Source: Solactive

Recent Developments – Chances in the Crisis

With a high degree of openness (74%, see above), the German economy is inevitably exposed to global risks, such as the COVID-19 pandemic. Interestingly, Germany has been doing relatively well during the current spread of the Coronavirus. Whereas, for instance until mid-August, the United Kingdom, with a population of around 67 million, has reported more than 40,000 deaths linked to COVID-19, the number of COVID-related deaths in Germany, with over 80 million inhabitants, stands at less than 10,000.7 Such differences may be attributed to a manifold of reasons which will be likely analyzed in the near future, and are not the main concern of this blogpost.

However, the fact that Germany is getting through the crisis in a relatively good shape is relevant for two reasons. First, if active COVID-19 cases stay low, then there is likely less need for a full lockdown. Hence, in a disciplined environment with appropriate distancing rules, many companies could operate at, or close to, 100% capacity, thus enabling themselves to be well prepared for the global economy returning to full speed. Whatever the recovery from the current crisis may look like, and regardless of timing, the trade-oriented economy may be among the main beneficiaries from a full-blown recovery. Second, as German crisis management is appearing to be effective, Germany has the lowest “anxiety score” among 15 analyzed countries in a survey conducted by Deloitte, which means that consumers are showing a lower degree of unease regarding their financial and physical health.8 A healthier consumer climate can serve as a more solid foundation for domestic economic stability and demand.

Final Remarks

Germany is among the most trade-oriented economies in the world. Whereas the constituents of the Solactive Germany 30 Index are well-established and world-renowned companies, the Solactive Mittelstand & MidCap Deutschland Index offers exposure to less-known but highly promising niche players. Although smaller in size, these hidden champions present higher profit margins and robustness, backed by both international and domestic revenues. The Mittelstand & Midcap Index has outperformed the Germany 30 index by about 6 percentage points this year and 29 percentage points over the past five years – also exhibiting a lower volatility during these timeframes. Being agile and prepared, the constituents of the Mittelstand & Midcap Index could further lever their competitive position within the global corporate sphere.

Dr. Axel Haus, Team Head Qualitative Research

Solactive AG

References

[1] Federal Ministry for Economic Affairs and Energy, “Facts about German foreign trade”, https://www.bmwi.de/Redaktion/EN/Publikationen/facts-about-german-foreign-trade.pdf?__blob=publicationFile&v=8.

[2] HelloFresh Q2 2020 Results Presentation, https://ir.hellofreshgroup.com/download/companies/hellofresh/Presentations/Q2_2020_Earnings_Call_Presentation_Final.pdf.

[3] Zooplus Annual Report 2019, https://investors.zooplus.com/wp-content/uploads/2020/03/en_zooplus_GB2019_200325_1030.pdf.

[4] Lab Supplies for Coronavirus Testing, Air Monitoring, and Vaccine Research, https://www.sartorius.com/en/pr/covid-19-solutions/covid-19-research-products.

[5] Delivery Hero Presentation Q2 Results 2020, https://ir.deliveryhero.com/download/companies/delivery/Presentations/Tradingupdate_2Q20_DeliveryHeroSE.pdf.

[6] Evotec Annual Report 2019, https://www.evotec.com/f/8f443bae31f2f8a01cb2032404962eb6.pdf.

[7] Worldometers, https://www.worldometers.info/coronavirus/.

[8] Deloitte, “Small positive signs in the consumers’ dual-front crisis”, https://www2.deloitte.com/us/en/insights/industry/retail-distribution/consumer-behavior-trends-state-of-the-consumer-tracker/covid-19-recovery.html.