Life is beautiful, and so are you: Solactive ARTIS® Beauty Index Concept

|

Beauty is a goal that many strive to achieve, as it is often associated with positive emotional reactions. Nowadays, given our deeper understanding of human bodies and technology, people have more options than ever to achieve beauty. The Solactive ARTIS® Beauty Index Concept is poised to benefit from the developing culture of creating one’s ideal appearance and own identity, which ultimately build up self-confidence. |

Solactive ARTIS® Beauty Index Concept

Beauty is a concept that is different across societies and that is constantly changing. It is also at the core of one of the oldest industries in the world, as cosmetics have even been used by ancient civilizations. For example, the application of eyeliner can be traced all the way to Queen Nefertiti, wife of Pharaoh Akhenaten of Ancient Egypt in 14th century BC. [1] By the 19th century, visual self-awareness developed amongst Europeans; so did chemical and medical research, which helped exclude some toxic and harmful cosmetic ingredients. Plastic surgery has experienced a boom after World War I, saving people from disfigurement. Lipsticks also entered the industrial production phase at roughly the same time. Following WWII, innovations in the cosmetics field sky-rocketed, while fashion gradually switched to a more natural look. Skin care products and healthy lifestyles have since become more predominant within the beauty industry. In the internet era that comes with influencers, trend-setters, celebrities, or information about achieving your own unique look, we can see people increasingly paying attention to appearance. In fact, the market of men’s beauty products has grown quietly but rapidly. The beauty industry is ready to take off.

The Solactive ARTIS® Beauty Index Concept is based on a global universe of stocks. The resulting index is comprised of top 10 companies in each of the following fields:

- Cosmetics (including makeups, hair care, and skin care)

- Fitness (including fitness studios, exercise equipment, and athletic apparel)

- Healthy food (including plant-based food, organic food, as well as nutritional and dietary supplements)

- Aesthetic medicine (including plastic surgery clinics and upstream materials)

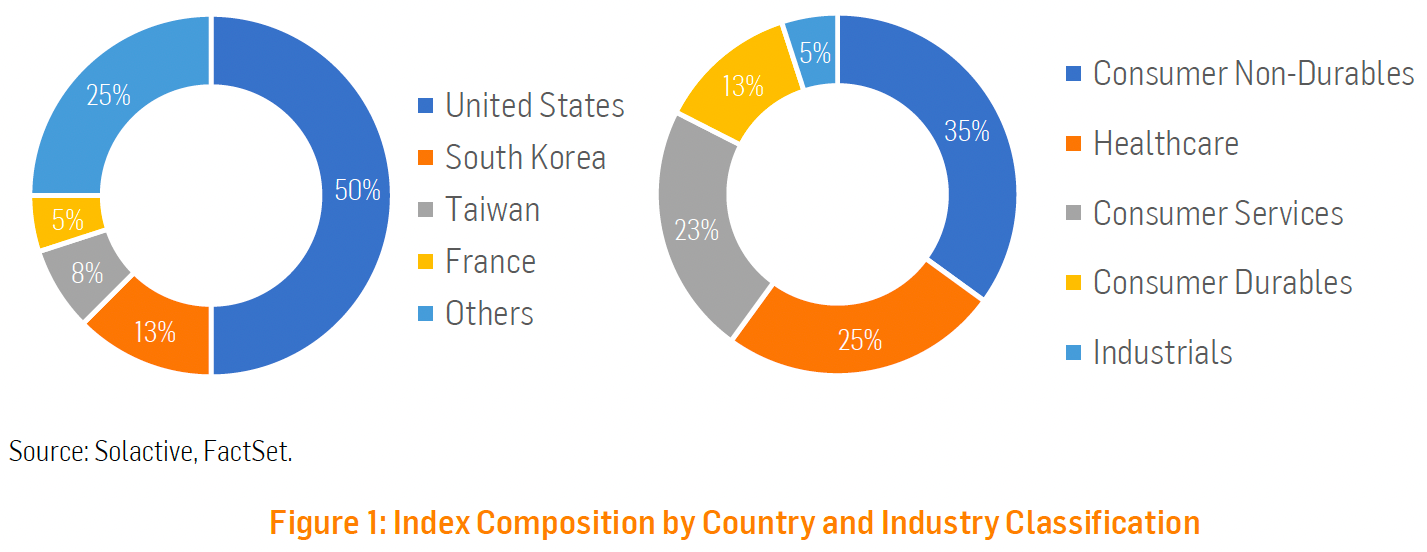

These fields all revolve around appearance. Out of the 40 index constituents, 14 are active in the field of consumer non-durables, nine are in consumer services, and five are active in consumer durables. Ten companies are active in the health care industry (mostly in the field of aesthetic medicine), and two companies are in the healthy food industry. The geographical distribution in terms of company incorporation is 50% in the United States, followed by South Korea, Taiwan, and France.

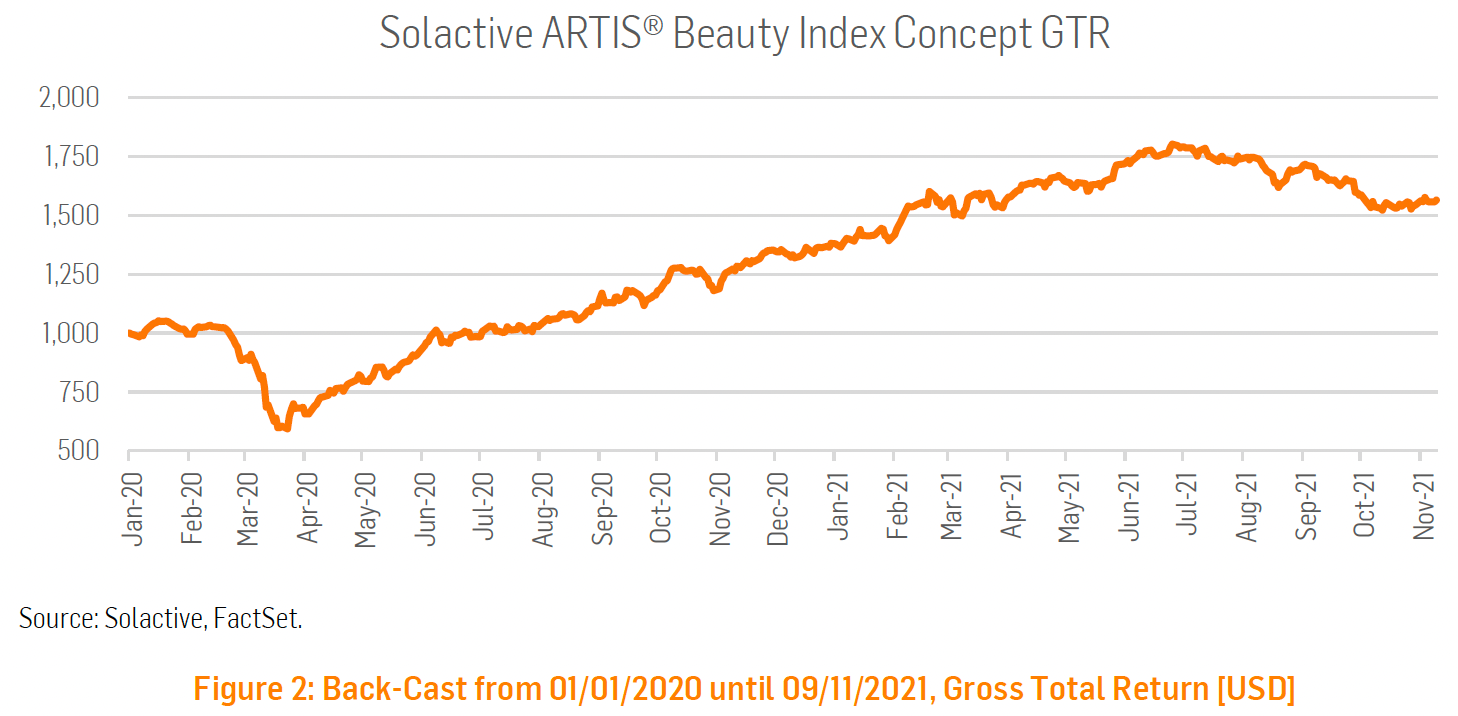

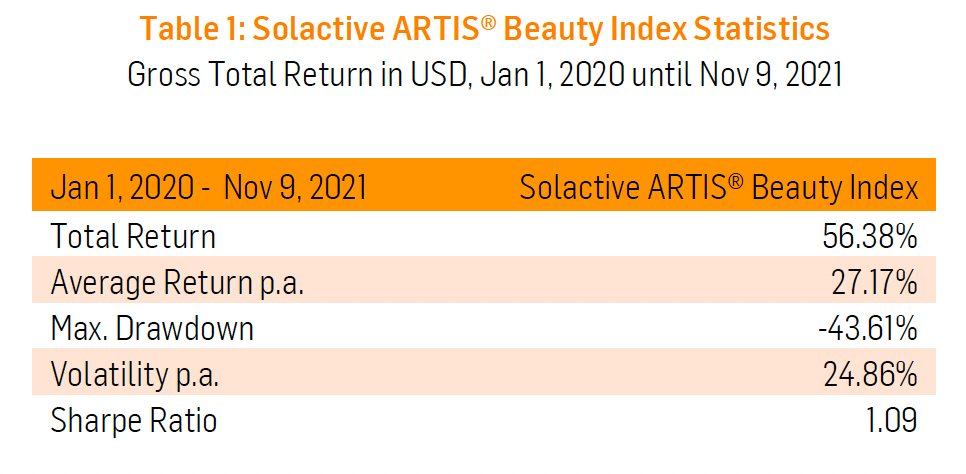

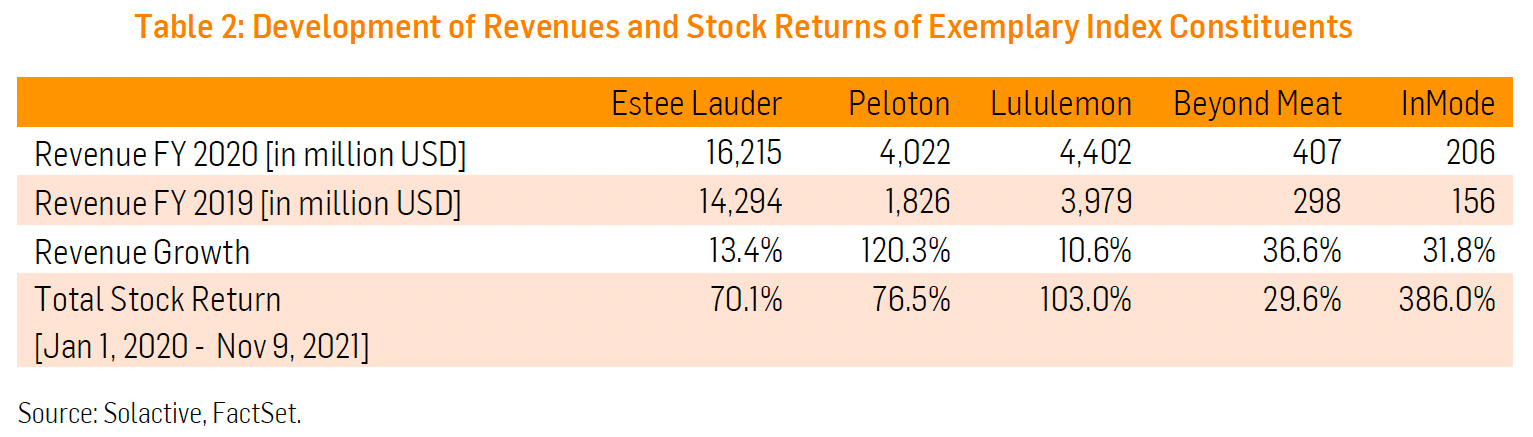

The basket selected in September 2021 demonstrated an average annualized return of 27.17% and a volatility of 24.86% over a 22 months back-cast ending in November 2021. The following companies are representative examples of index constituents and different covered business areas:

- L’Oréal SA (France), founded in 1909 in the suburbs of Paris, is the largest cosmetics company in the world. L’Oréal originally provided hair dye at the very beginning, but now has four product divisions aiming at different consumers, and owns more than 50 brands globally, including Lancôme, Kiehl’s, Garnier, Maybelline, NYX, La Roche-Posay, etc.

- Peloton Interactive Inc. (United States), founded in 2012 in New York, provides fitness training equipment for home training, including treadmills and stationary bikes. With a focus on cardio machines with digital fitness classes, Peloton experienced an explosive expansion during the COVID-19 outbreak.

- Lululemon Athletica, Inc. (Canada), founded in Vancouver in 1998, used to focus on designing yoga pants for women. Now it produces not only yoga accessories, but also sport clothes for everyone. In late 2020, via acquisition, it introduced a home personal training assistant: Mirror.

- Beyond Meat, Inc. (United States), founded in 2009 in California, is a plant-based protein food company. Although it is not the first company in the meat-substitute field, it is the world’s first one that sells its products in grocery stores[2], and it is the first vegan meat company that had an IPO.

- InMode Ltd. (Israel), founded in 2014, is an innovative medical aesthetic company that offers body contouring, facial skin treatment, and hair removal equipment. Its novel radio frequency technical systems provide fat removal and skin remodelling via minimally invasive or non-invasive treatments.

What’s Trending?

It is said that 96% of beauty brands are active on social media. We cannot confirm that the number is legitimate, but social media platforms definitely play a big role in shaping the beauty standards of the new generation. As people spend more time on social media platforms thanks to the high coverage rate of smart phones, posts and views are also on the rise. Key opinion leaders (KOL) or influencers will carefully prepare everything else besides content, including their appearance and the background that is set up to appeal to their followers. The fashion styles, makeups, and even accessories of KOLs are viewed by millions of followers, and the viewer base is even broader when considering reposts. Therefore, internet celebrities are often recruited by companies to post sponsored content that advertises their branded products.

The marketing strategies of new beauty companies are based on a deep understanding of user-generated content. Fitness and healthy food are two very popular topics on social media, not only because they help people achieve more attractive bodies, but also because a lot of people find it enjoyable to watch people showing their strengths, skills, and healthy lifestyles that inspire and motivate people to live a healthier, better life. More than one million of #thesweatlife hashtags have helped Lululemon transform from a small yoga pants manufacturer to a big athletic apparel company. Beyond Meat also became the first company to sell plant-based burger patties in grocery stores with the help of a wide range of selected influencers, including Jessica Chastain and Snoop Dogg.

On the other side, more and more people desire to build their own, unique style rather than just to follow a predefined beauty standard. People start to invest in makeups not only to follow trends, but also to stand out among others – especially on the internet, where they create a parallel internet persona.

Permanent Makeup and Aesthetic Medicine

Although millennials might be the pioneers of “style customization” as well as the followers of the latest trends, mature consumers of cosmetics are more likely to spend more money. The consumption is due to a desire to remain youthful and beautiful, and that can be supported by a higher and more stable income. Cosmetics and body care products can help people ameliorate wrinkles, adjust skin tones, or enhance appearance in many other ways. Aesthetic medicine can help with achieving the “ideal body” for a longer (or even permanent) period. From the mildest non-surgical body hair removal, artificial tattooed eyebrows, botulinum toxin injection, to body contouring, breast augmentation, or even nose or face reshaping, aesthetic medicine covers more aspects of our bodies than we can imagine. The medical aesthetic industry will further increase due to a growing global aging population, and due to rising income and acceptance in developing countries. According to Research and Markets, the medical aesthetics market is expected to grow at a CAGR of almost 10% until 2029. [3]

Lipstick Effect or Mascara Index

The COVID-19 pandemic has affected the economic status of many small business owners and employees significantly. The lipstick effect – the theory (by Leonard Lauder) that consumers will buy small luxury lipsticks during a crisis – seemed like it would be proven again, as it was during the 1930s Great Depression and the 2008 financial crisis. But, in 2020, the lipsticks prewrapped as “pick-me-up presents” did not experience the two-digit sales growth seen during the previous crises. The biggest disadvantage for the beauty industry was the lockdown policy around the world that made people stay at home. People tend to not apply cosmetics while staying at home in the absence of social interactions. Companies in the beauty industry had to transfer their main revenue source from cosmetics to soap, disinfectant, and personal care products. In fact, sales of high-end soap in France have risen by 800% in early March 2020. [4] At the same time, as the majority of sales moved online due to the lockdown, some companies also took the chance to improve their ecommerce supply chain to adapt to the swarming online orders. Some companies also started to offer personalized solutions using artificial intelligence to provide customized products that perfectly match the customer’s requirements. Arguably, the digital transformation pushed by the pandemic can eventually help the industry to benefit in the long term.

As the restrictions start to loosen, we can expect that social events will make a come-back, albeit with certain rules like wearing a mask. In this context, the importance of lipsticks may fade with respect to mascara, as lips are covered under masks while eyes become the predominant feature on our faces. Given that the lipstick effect didn’t occur, a mascara index may be a better evaluation of the cosmetic industry. [5] In other words, the beauty industry can be expected to make a strong recovery. The “better” the appearance we achieve, the more intense the happiness of joining a post-lockdown party we appreciate.

General Remarks

Whether looking at cosmetics, fitness, healthy food, or aesthetic medicine, the goal is the same: a better image. People can build up their confidence through attaining their ideal appearance. Mankind’s ever-lasting desire of achieving beauty will continue driving demand in the related industries – therefore the Solactive ARTIS® Beauty Index Concept is poised to benefit. As the pandemic is gradually getting under control, we can expect that the performance of the index will be supported by upcoming social events to a new high.

Xiaocheng Lin, Research

Solactive AG

References

|

[1] |

L. Ettachfini, “The History of Eyeliner,” 29 August 2018. [Online]. Available: https://www.vice.com/en/article/kzyda9/history-of-eyeliner-kohl. |

|

[2] |

T. Bellon, “Beyond Meat’s home in the meat aisle sparks food fight,” 6 June 2019. [Online]. Available: https://www.reuters.com/article/us-beyond-meat-retail-focus-idUSKCN1T7162. |

|

[3] |

R. a. Markets, “Worldwide Medical Aesthetics Industry – Market is Expected to Grow at a CAGR of 9.9% Between 2021 to 2029,” 05 March 2021. [Online]. Available: https://www.globenewswire.com/en/news-release/2021/03/05/2187849/28124/en/Worldwide-Medical-Aesthetics-Industry-Market-is-Expected-to-Grow-at-a-CAGR-of-9-9-Between-2021-to-2029.html. |

|

[4] |

“Confinement : mauvaise passe pour les produits de beauté haut de gamme… à deux exceptions près,” Fashion Network, 10 April 2020. [Online]. Available: https://fr.fashionnetwork.com/news/Confinement-mauvaise-passe-pour-les-produits-de-beaute-haut-de-gamme-a-deux-exceptions-pres,1206019.html. |

|

[5] |

R. King, “Zoom and face masks are giving cosmetics brands an eye lift”, Fortune, 12 August 2020. [Online]. Available: https://fortune.com/2020/08/12/face-masks-eye-makeup-beauty-sales/. |