Downside Volatility – Performance Snapshot – H1 2019

DOWNSIDE VOLATILITY AFTER DECADES’ MOST SEVERE CORRECTION

After we have witnessed this decade’s most severe market correction right at last year’s end, it’s especially intriguing to look at the performance of low-risk strategies over the subsequent six months. Naturally, after such an event, volatility – as one of the most popular defensive factors – is in the spotlight. We should, therefore, check how our downside volatility strategies performed in the first half of 2019.

METHODOLOGY

The starting universe for the indices we look at is the Solactive US Large Cap Index. An additional liquidity filter of USD 5mn average daily volume is applied to the index universe. The index currency is USD, and all indices are calculated as Gross Total Return during the period from January 1st till June 28th.

For Solactive’s US LC Low Downside Volatility Index, all stocks are weighted according to the inverse of their downside volatility1. To compute the downside volatility of every stock, we utilize a lookback period of 252 trading days. The Low Volatility index is built analogously using regular standard deviation.

The constituents of the Solactive US LC Minimum Downside Volatility Index are determined by the following optimization problem:

![]()

where ω is a vector of weights and Σ is the semi-covariance matrix. For Solactive’s US LC Minimum Volatility Index, we solve the same optimization problem using the traditional covariance matrix. Both portfolios consist of 100 stocks. The optimization problems are subject to several constraints such as a turnover constraint, relative sector caps, and a maximum and minimum single security weight.

RESULTS AND DISCUSSION

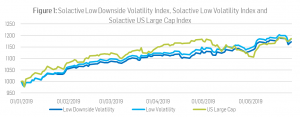

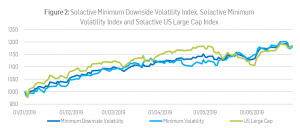

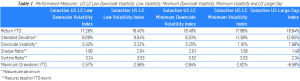

After last year’s correction, we saw a substantial market recovery at the beginning of this year, resulting in positive returns of the equity market in the first six months of 2019. With 12.60% annualized volatility in the first six months, the benchmark was also not very volatile. Still, our downside volatility strategies managed to achieve substantially lower risk metrics while realizing returns close to the benchmark. With drawdowns lowered by as much as 4.03 percentage points, low-risk strategies were still an attractive investment in this year’s bull market.

However, as earlier performance updates impressively show, downside volatility strategies function especially well as a safeguard to prevent portfolios from massive drawdowns in turbulent market conditions.

As markets currently experience record highs, future corrections are likely. Considering, for instance, the trade war between Trump and China still simmering, further Trump and FED strife on the horizons, and moreover stagnant and challenging Brexit negotiations, market corrections could easily wipe out carefully accumulated profit. Since recovery from severe losses takes incomparably more effort to reach the status quo again, it is always better to be safe than sorry.