Downside Volatility – Performance in 2018

DOWNSIDE VOLATILITY IN THE WHOLE YEAR OF 2018

In our previous blog, Downside Volatility: Performance Snapshot H1 2018, we looked at the performance of our downside volatility strategies for the first half of 2018[1]. It showcased that downside volatility strategies harvest the low risk premium without cannibalizing upside potential, outperforming plain volatility strategies over a short period of time. But how did the strategies perform during the whole course of 2018, when the global economy grew slightly but the stock market witnessed turbulence?

Downside volatility during turbulent times

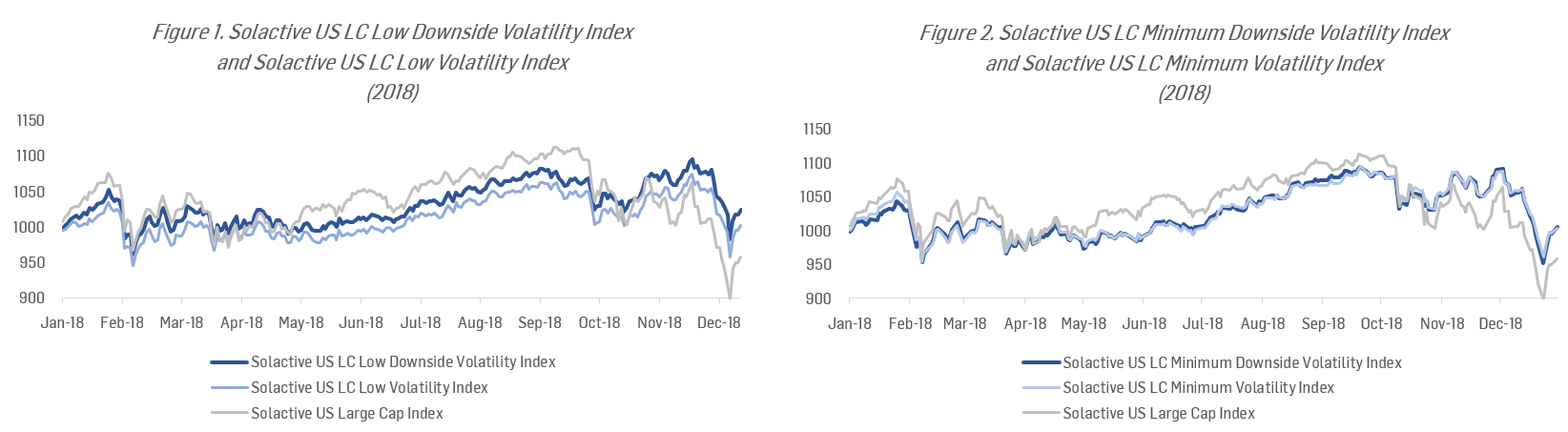

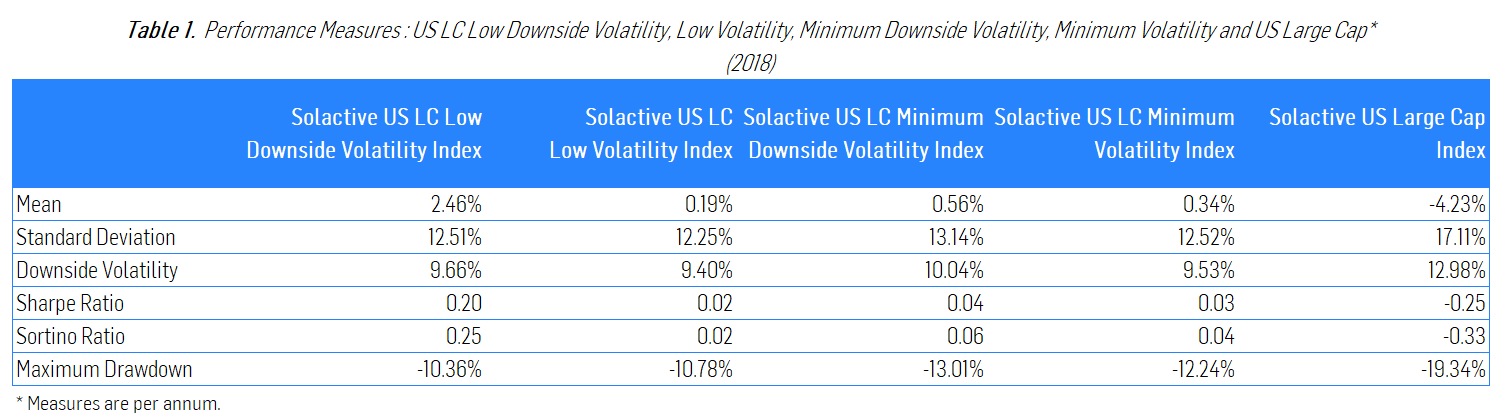

2018 was a very turbulent year, and again alerted investors to stay vigilant about risk: geopolitical tensions in Europe, the US Midterm Election, the ongoing “trade war” initiated by the US against multiple nations, with no valid potential outcome in sight were key events that provoked high insecurity amongst investors. How did downside volatility strategies manage to perform in these tumultuous times? The performance in Figure 1 & 2 and Table 1 illustrates the following defensive characteristics of downside volatility strategies:

- Higher realized return: Compared to plain volatility strategies, the Solactive US Large Cap (LC) Low Downside Volatility Index continues to outperform strongly with a positive return of 2.46% (vs. 0.19% for the Solactive US LC Low Volatility Index). The Solactive US LC Minimum Downside Volatility Index also experiences a slightly better return (0.56% vs. 0.34%).

- Well-managed risk measures: Risk levels are well managed for downside volatility strategies, with a standard deviation of 12.51% and 13.14% for the Solactive US LC Low Downside Volatility Index and the Solactive US LC Minimum Downside Volatility, respectively. Meanwhile, the benchmark, the Solactive US Large Cap Index, is more volatile with 17.11% standard deviation.

- Improved risk-adjusted return profile: Compared to plain volatility strategies, the Solactive US LC Low Downside Volatility Index continues to outperform strongly with a Sharpe ratio of 0.2 against 0.02 for the Solactive US LC Low Volatility Index. The Solactive US LC Minimum Downside Volatility Index has also seen a slightly improved risk-return profile (0.04 vs. 0.03), while the Sharpe ratio of the benchmark remains negative.

The whole year performance once again emphasizes the capability of downside volatility strategies to generate better returns alongside improved deviation and Sharpe ratio. The better resilience relies on downside volatility’s ability to ‘punish’ undesirable negative returns only.

Outlook

Now that the books are closed on 2018, it is the point in time to look into 2019: with the Fed rate hiking and the ECB phasing out Quantitative Easing, monetary policy in major countries is set to normalize further. Pressing credit conditions, rising core inflation, and tightening labor markets are likely to result in a moderate slow down of the global economy. Moreover, unresolved geopolitical tensions, ranging from Brexit to the Italian budget dispute, could stir the financial markets even further. Thus, we expect the global economy to enter the late economic cycle and stock markets to continue being turbulent. The year 2019 might witness a shift of investors’ appetite from return seeking to risk managing, implying opportunities for downside volatility strategies.

Conclusion

To conclude, the performance in 2018 has proven that downside volatility strategies are able to harvest the low-risk anomaly without compromising upside potential. They generate overperformance over plain volatility strategies and the relevant benchmarks. Particularly, in turbulent markets, downside volatility strategies demonstrate an ability to limit large drawdowns, while providing momentum for a further resurgence. The longer a global equity market rally continues, the higher the probability that a market correction will materialize. Therefore downside volatility strategies are going to continue to be a good alternative in shaky markets.

[1] For more information, please see Solactive White Paper series, “The Downside of Low Volatility” and “Minimum Downside Volatility Indices”